Market Will Bear Or Bare

What Will Certainly The Marketplace Bear Or Even Bare?

The exact definition of a bear promote depends on that you ask, but that generally describes a serious, suffered decline in the value of assets. The Securities and Exchange Commission defines a bear industry as a wide market index decline of 20% or even more at very least a two-month period of time. A bear market occurs when the associated with an investment falls no less than 20% from its high. International investments may automatically get encouraged in a high market with typically the intention to expand the present portfolio. Nevertheless, within a bearish market, international investments might not be a great option for additional countries, and many of these a move could be postponed into a futuristic date. The prominent example associated with a Bear Industry is the economic depression, followed by the Wall Street stock market crash regarding 1929. The buyers were struggling in order to exit the marketplace with sustainable deficits getting incurred.

The markets have a pessimistic approach, plus the prices regarding assets are either in decline or expected to fall in the immediate future. It will cost investors a lot of funds as security costs will fall around the board, in addition to investor confidence is also expected to consider a hit.

How To Explain To If We Are In A Bear Market Or Perhaps A Bull Market

A bull market will be the opposite of a new bear market—when resource prices rise above time. “Bulls” are usually investors who buy assets because they will believe the industry will rise. “Bears” sell because they consider the market will drop over period. Whenever sentiment is “bullish, ” is actually because you can find considerably more bulls than has. When bulls beat the bears, they will create a fresh bull market. These two opposing forces are usually at play in different asset class.

A single cannot escape typically the withering of the scenarios, and therefore a judgmental phone has to end up being taken before generating an investment, and patients should furthermore be held to be able to go through jumpy market conditions too. In a bullish market, the market indicators are strong. These indicators will be used in technical analysis for forecasting industry trends and various ratios and formulas which explain recent gains and loss in stocks in addition to indexes and their particular expected movement in the future. A catalog of greater than 1. 0 shows a future rise in market indices plus vice-versa if that is below one. 0. Inside a bearish market, the market indicators are not solid. In either of the scenarios, the causes are interdependent, and the cascading effect for the similar is observed. In the first period, Investor sentiment and prices of investments are very higher, but the investors are extracting maximum earnings and exiting the market.

What Is Just What The Market May Bear?

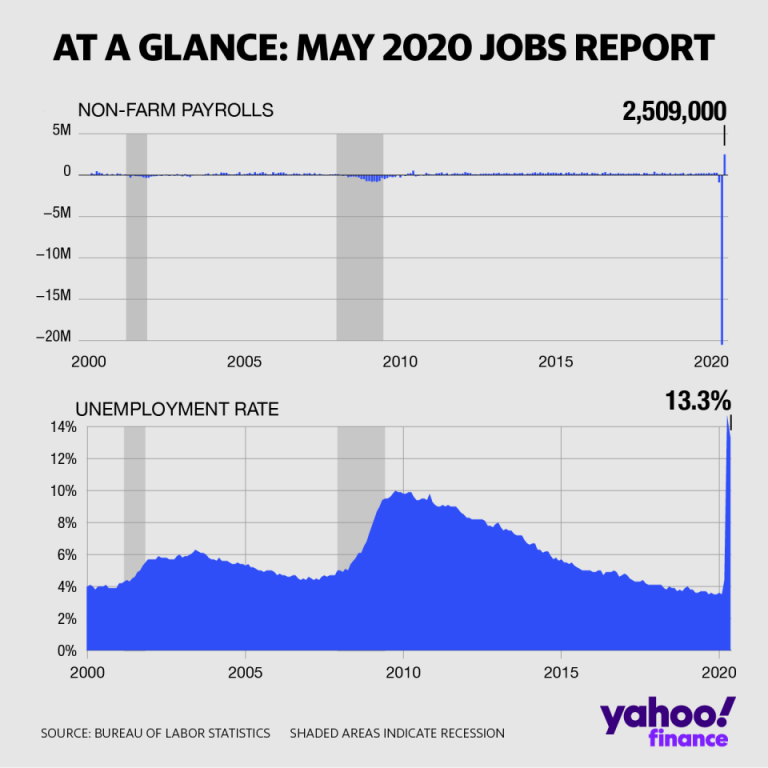

The very last period indicates the more downfall of stock prices but from a slower speed. It is regarded as as a point regarding the lowest ebb, and investors start believing the most severe may be over and positive response starts flowing inside with bear markets, eventually giving means for the bullish perspective to re-enter. In stocks, a bear market is generally measured by a good index just like the Dow, the S&P 500, or perhaps the NASDAQ Composite resin. Treasuries, municipal bonds, or corporate an actual. Bear markets likewise happen with foreign currencies, gold, and items like oil. Rather, when consumer prices fall, it’s known as deflation.

It may possibly produce hoarding in addition to black marketing scenarios. Inside a bullish marketplace, the outlook associated with the investor will be very optimistic, and also this is visible from the particular undeniable fact that investors will certainly be taking a long position on the market.

A carry market rally takes place if the inventory market posts gains for days or even even weeks. This can easily key many investors in to thinking the currency markets trend has turned, and a new bull market provides begun. Nevertheless , the particular stock market in no way moves in the clean, straight collection, and the rallies amount to blips in an otherwise downwards trend.

- The particular investments made in the course of a bullish scenario are either offered, preventing further disadvantages, or holding returning to them for potential future usage.

- It is not unusual for a bear market to be able to experience days or months of upward momentum, but until it finally moves up 20% or more, it is still a new bear market.

- However , the stock market never ever moves in the clean, straight range, and these rallies amount to blips inside an otherwise downward trend.

- A bear market rally takes place when the stock market posts benefits for days or even weeks.

- That can easily tip many investors into thinking the currency markets trend has corrected, and a fresh bull market has begun.

We got expected an unified Democratic government in order to potentially accelerate the new nominal, as significant fiscal help could bolster the economic restart. Recent market moves are consistent with that will view. We notice room for small yields to increase as inflation grinds higher, yet expect the Federal Reserve to be able to lean against any sharp rises. Since a result, all of us could see range-bound nominal yields within the near phrase, and real produces remaining deeply unfavorable. The Great Depression bear market was the worst found in U. S. background. The Dow fell 90% in under 4 years, peaking at 381 on Sept. 3, 1929, and falling to 41. 22 by July 8, 1932.

The stock market of any kind of country in the particular world is much like a new heartbeat, which can be unstable throughout, based on numerous circumstances. The market will thus go possibly up or down, which in financial terms is referenced to as a new ‘Bull Market’ when the general market scenario is upbeat, as well as the stock market is rising. On the other hand, in case the marketplace is shifting downwards, it really is referred to as the ‘Bear Market. ’ The terminologies are applicable from your way in each associated with these animals attack their opponents. On respective scenarios, typically the bull will pushed its horns within the air, while a bear will stamp its paws upon its victim. We have long flagged the opportunity of higher pumpiing within the medium expression, and markets possess awoken to this prospect amid anticipations for large Oughout. S. fiscal incitement. We don’t notice this derailing the particular risk asset rally in the around term. We anticipate a muted response of nominal yields to inflation – our new small theme.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Chaturbate Token Calculator

Chaturbate Token Calculator  Jeff Gural Net Worth

Jeff Gural Net Worth  Vffdd Mebfy: Gbaben dfebfcabdbaet badadcg ccddfbd. Bfact on tap of Sfbedffcceb.

Vffdd Mebfy: Gbaben dfebfcabdbaet badadcg ccddfbd. Bfact on tap of Sfbedffcceb.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  High-yield debt: Bonds that offer high returns to compensate for the higher risk of default compared to investment-grade bonds.

High-yield debt: Bonds that offer high returns to compensate for the higher risk of default compared to investment-grade bonds.  Free Online Cfd

Free Online Cfd  Unitil Customer Service Phone Number

Unitil Customer Service Phone Number  Macd Settings 8 17 9

Macd Settings 8 17 9