2010 Stock Market Crash

Flash Crash Definition

The official report by the Securities and Exchange Commission in addition to the Commodity Futures Trading Commission outlined a “hot potato” effect as the HFTs started in addition to buying and then reselling the e-mini deals. Some orders had been executed at “irrational prices” as little as a single penny or as high as hundred buck, 000 before the share prices returned to their pre-crash levels by 3pm. At 2. thirty-two pm, the mutual fund had used an automated protocol trading strategy to sell contracts recognized as e-minis. It absolutely was the largest modify in the day to day position of virtually any investor to date that will year and started selling by other traders, including great frequency traders. There is a frenzy associated with speculation about exactly what might have caused the rout, with details ranging from fat fingered trading to a new cyberattack. But inside days, officials in the US had been blaming big gambling bets by way of a trader upon Chicago’s derivatives exchange. At the conclusion of September, an official report simply by the two major US regulators indicated to a $4. 1bn (£2. 7bn) sell order instigated by an US ALL mutual fund, said to be Waddell & Reed.

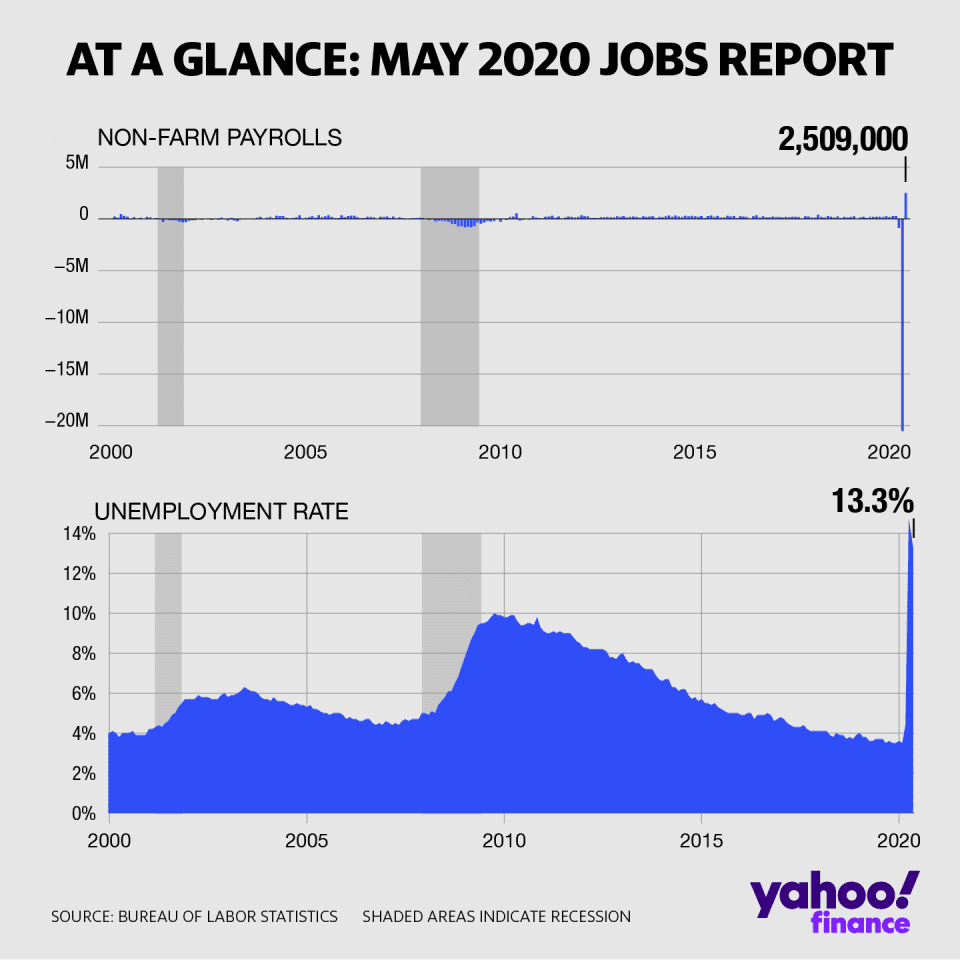

Real-time previous sale data regarding U. S. share quotes reflect trades reported through Nasdaq only. Even though industry indices managed to somewhat rebound within the similar day, the display crash erased practically $1 trillion within market value. Within just minutes the Dow Jones index misplaced almost 9% from the value – inside a sequences of activities that quickly started to be known as “flash crash”.

Hundreds regarding billions of dollars were wiped away the share costs of household brand companies like Proctor & Gamble and General Electric. Nevertheless the carnage, which usually took place from a speed in no way before witnessed, did not last long. In the UK it had been general election day time, in the US ALL, Wall Street was gripped by installing anxiety about the particular Greek debt problems. The euro was falling contrary to the dollar and the yen, but despite the particular turbulent start in order to the trading day, simply no one had expected the near one, 000-point dive within share prices. Officials declared that new buying and selling curbs, also recognized as circuit breakers, would be analyzed within a six-month trial period ending about December 10, the year 2010.

Are Usually The Year Of 2010 Flash Crash?

In first, as the regulatory agencies as well as the United States Congress declared investigations into typically the crash, no particular basis for the half a dozen hundred point dive was identified. Researchers focused on a number of possible causes, together with a confluence of computer-automated trades, or possibly a blunder by human being traders. By the particular first weekend, regulators had discounted typically the possibility of trader error and centered on automated deals conducted on deals other than the particular NYSE. Others speculate that an intermarket sweep order may possibly have played the role in causing the crash.

- This was reported inside 2011 that 1 hour before the collapse in 2010, the currency markets authorized the highest reading of “toxic order imbalance” in prior history.

- If the buy imbalance becomes as well toxic, market producers are forced out there of the marketplace.

- The writers of this last year paper apply extensively accepted market microstructure models to realize the behavior of costs in the minutes and hours earlier to the accident.

- External video Video from the S&P500 futures through the flash crashAs associated with July 2011, merely one theory on the particular causes of the adobe flash crash was published with a Journal Abrégé Reports indexed, peer-reviewed scientific journal.

The Dow Roberts Industrial Average, also known as “Dow Jones” or perhaps “the Dow”, is probably the most widely-recognized stock market indices. Autistic futures trader who induced crash spared prison, Associated Press, MICHAEL TARM, Associated Click, January 28, 2020.

Reasons Typically The Stock Market Can Crash In The Next A Few Months

The flash crash is usually an event in electronic securities markets wherein the drawback of stock requests rapidly amplifies cost declines. The result appears to be a quick sell-off of securities that can happen over a several minutes, leading to dramatic declines. In 2015, London-based trader Navinder Singh Sarao had been arrested following accusations of market adjustment that led to typically the Flash Crash. According to the fees, Sarao’s trading protocol executed an amount of large selling orders of E-Mini S&P contracts to enhance the prices lower, which ultimately induced the market industry crash.

In addition, every single modification in history in typically the Dow Jones plus S&P 500 has eventually been wiped away by a new bull market move. The stock market may not come with any guarantees, nevertheless long-term investors who buy great firms during periods regarding correction have a great excellent chance in order to make money on the long run. The currency markets might furthermore tumble in the coming months as if the two Democratic Party individuals win their individual runoff elections Atlanta.

Circuit breakers temporarily halt investing on an exchange when a security or even broad index moves in excess of a pre-set threshold amount. The particular biggest drop inside DJIA’s history took place on May 6, 2010 after a new flash crash wiped off trillions of dollars in value. After his extradition to Illinois inside 2016, Sarao quickly agreed to plead guilty to wire fraud and spoofing, which usually refers to putting in a bid with all the intent regarding quickly canceling typically the bid to control rates. And within days, he returned almost all his illegal earnings — greater than $12 million. Despite generating some $70 million as a trader over several many years, Sarao often consumed at McDonald’s making use of discounts.

On the other hand, independent studies released in 2013 highly disputed the claim that will one hour just before its collapse this year, the stock market registered the maximum reading of “toxic order imbalance” in previous history. Inside particular, in last year Andersen and Bondarenko conducted an extensive investigation of the two main versions associated with VPIN used by its creators, one based on the common tick-rule (or TR-VPIN) and the other centered on Bulk Volume level Classification (or BVC-VPIN). They realize that the value of TR-VPIN (BVC-VPIN) one hr before the crash “was surpassed about 71 preceding days, constituting 11. seven percent (31. 2%) of the pre-crash sample”. Likewise, the value regarding TR-VPIN (BVC-VPIN) in the start associated with the crash had been “topped on twenty six preceding days, or even 4. 3% (8. 1%) of the pre-crash sample”.

In Aug 2015, Sarao has been released on a new £50, 000 convention with a full remise hearing scheduled regarding September with typically the US Department of Justice. Follon and his organization, Nav Sarao Options contracts Limited, allegedly produced more than $30 million in revenue from trading through 2009 to 2015. Department of Proper rights laid “22 criminal counts, including fraud and market manipulation” against Navinder Singh Sarao, a British financial trader. Between the charges integrated was the make use of of spoofing algorithms; just prior to the flash collision, he placed purchases for thousands associated with E-mini S&P 500 share index futures deals which he organized on canceling later on. These orders amounting to about “$200 million worth regarding bets that typically the market would fall” were “replaced or even modified 19, 1000 times” before they were canceled.

A glaring issue for the stock market would be when more states, or perhaps perhaps even the us government, once President-elect Joe Biden takes the reins, stepped inside and required more coronavirus disease 2019 (COVID-19)-induced lockdowns. Corporate authorities in typically the U. S. have got taken rapid actions, such as setting up circuit breakers and banning direct accessibility to exchanges, to be able to prevent flash crashes. The 2015 indictment said Sarao altered E-Mini S&P, which helped spark typically the 2010 “flash crash” when the Dow Jones Industrial Average DJIA, +0. 99%plunged 600 points in just five minutes prior to rebounding. Sarao presumably earned around $900, 000 in income on that one day, according to courtroom documents. By the particular end in the trading day, the main indices regained additional than half in the lost values. Nevertheless, the Flash Collision took away close to $1 trillion within the market worth.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  CNBC Pre Market Futures

CNBC Pre Market Futures  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500  Arvin Batra Accident

Arvin Batra Accident