Banking as a Service: End-to-end online process that ensures the overall execution of a financial service.

The space will continue to be well funded as additional use instances expand the addressable market.

Should that happen, enablers will continue steadily to play a significant part in helping platforms navigate intricate regulatory, financial, and technical requirements.

Even if they do not make it themselves, the expert understanding of fintech authorities and engineers will undoubtedly be crucial to platforms’ continuing success.

- Allowing new individuals to depend on AML/CFT prerequisites of traditional financial institutions such as Customer Due Diligence , data collection and transaction monitoring without having them to perform these duties by themselves account, should be avoided.

- While at the starting point this layer might not seem especially significant, as FinTech services continue to develop as a segment in the fiscal service market, services performed by Cloudworkers will take on increased importance.

- Furthermore, some Member Says have already been or are gold plating the EU client protection and financial market regulations.

ETRUST’s and IPWG’s concern is to raise the public’s awareness just enough to make it need eTRUST and P3, but not more than enough that it puts the problem in to the hands of the government.

This query is of broad interest, since both of these groups face the fundamental challenges of anyone trying to foster self-regulation in order to forestall government regulation.

The Boston Consulting Party volunteered to accomplish a pro-bono evaluation of eTRUST’s positioning and leads, and its mid-term findings promise some intriguing conclusions, for eTRUST specifically, for P3 and for some other such efforts down the road.

These methods are contractual, and they can work without the changes in existing legislation.

Electronic Banking Adoption Is Growing Globally

For example, Affirm tries to eliminate credit card companies from the web shopping process by giving consumers a way to immediately take out short-term loans for purchases.

Alternatively, traditional banks are usually leveraging their infrastructure and checking their application programming interfaces to web host fintech stacks that deploy Banking-as-a-Service solutions.

Digital banking describes the entire digitization of end-to-conclusion banking processes and is an umbrella expression that encompasses both on-line and mobile banking.

Increased adoption of Open APIs and Microservices architecture – Digital banking services have to support seamless integration and agility.

Open APIs enable smooth interoperability between unique mediums, which allows the bank’s core system to activate with third-party vendors.

Microservices architecture may be used to break down banking applications into sub-services that may communicate seamlessly via open APIs.

It really is however important inside our opinion to likewise incorporate customers and their behaviour in the centre of the evaluation of how new technology are creating prudential risks and opportunities.

Besides the dependence on harmonisation among EU monetary supervisors outsourcing regulation, you will find a need to provide agility to the cloud adoption procedure, reducing time to market to improve competitiveness.

Simply put, FinTech may be the marriage of technology and financing giving startups and service providers the ability to offer streamlined financial goods/services that were previously only available through heavy-regulated, traditional finance institutions.

Cases of FinTechs that are changing how individuals and businesses deal with repayment processing and borrowing money are Square, PayPal, Financing Club and Prosper.

Today’s and potential future FinTech startups happen to be poised to revolutionize the banking market and give traditional banks a go for their money.

The report gathered info from 1,600 financing sector executives who highlighted the potential influence of Banking as something in APAC on companies and the entire financial services ecosystem.

The competitors in the sector include financial institutions taking the function of providers, followed closely by the enablers, which will be BigTech and fintech companies that integrate financial solutions into third-party systems and apps.

The remaining players are the distributors, which are business brands offering embedded financial solutions to consumers.

It must accurately reflect the provider’s views with regards to their interactions with the client and meeting the objectives of the business.

Preliminary financial forecasts project that eTRUST can become self-sustaining after a two year ramp-up time period.

In the mean period, sponsorships provides the financial resources to build up the company and fund procedures for the initial two years.

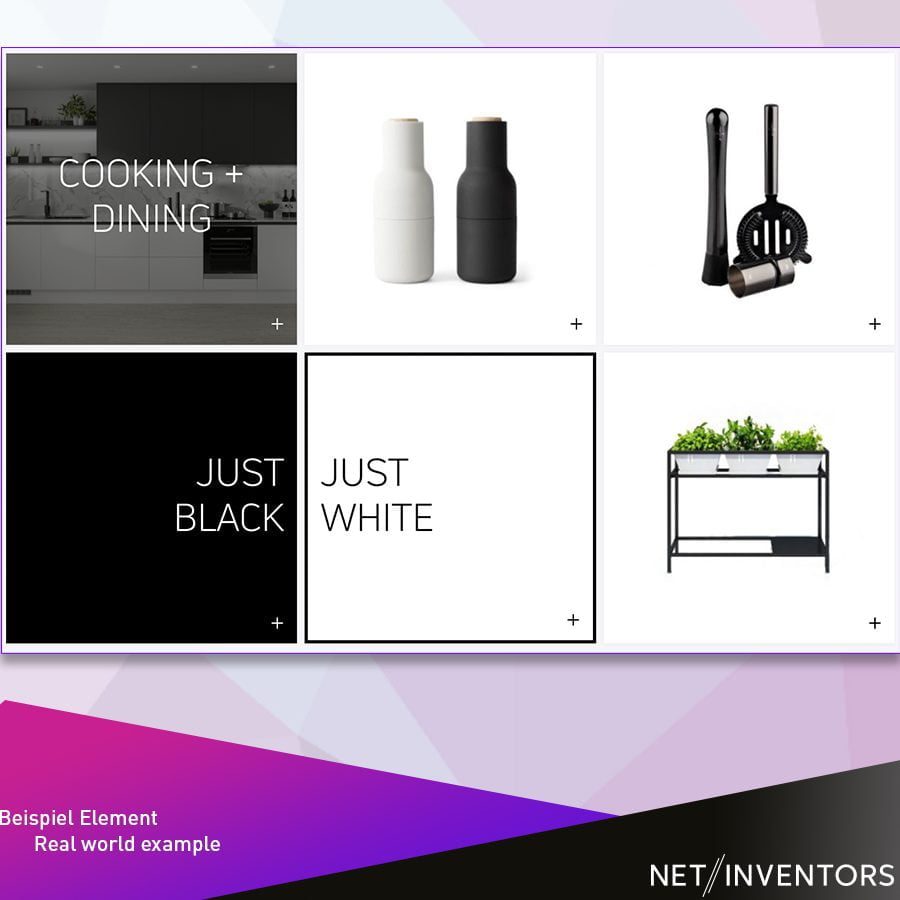

Regardless Your Business Size And Scope, Let’s Grow Together

In the interim eTRUST is definitely seeking sponsors to supply seed money to aid eTRUST in the startup phase and to subsidize the first 2 yrs of operation.

CommerceNet and the EFF then joined together with each other in October 1996 to form a partnership of sector and consumers to develop and carry out the eTRUST notion.

Commerce Net is regarded as a leader in electronic commerce with over 200 international member organizations and organizations.

EFF is a known champion of civil liberties and customer rights in the electric medium with widespread influence with consumers worldwide.

In order to get hold of an eTRUST trustmark license, an applicant organization must submit to a site review ahead of receiving the license, to ensure conformance with guidelines.

Furthermore, eTRUST may conduct subsequent audits of the website at any time through the license period.

- It also allows the company to better monitor the procedure from the planning period to the execution phase, ensuring that the project produces the outcomes that the business desires.

- These proprietary banking apps host a range of e-resources that enable consumers to monitor and manage their fiscal assets, make financial well being assessments, utilize predictive analytics, and receive tailored insights.

- The bank has to seek new revenue streams and save well on existing bills while delivering third-party services on its platform, even if that requires customers to incur monetary and non-monetary costs when they reach out to service providers to select the right product.

- is certified from Metromail; the e-mail addresses come from user registrations , public-domain web directories online , and Usenet .

- Other vocabularies might also employ multiple dimensions, for example, one dimension for procedures pertaining to each kind of information a niche site collects (demographic information, get in touch with information, transactional files, etc.).

However, if most World wide web content and service providers provided notice and option through traditional methods, interruptions will be a common occurrence.

Fortunately, numerous alternative mechanisms may facilitate the provision of notice and decision over telecommunications systems while preserving the smooth browsing experience.

on the necessity for high levels of consumer protection, the current presence of so many unregulated entities (53% non-supervised) suggests that further investigation must ensure that entities are treated similarly.

How banking institutions can future-proof organization with automation, digitalization and agility to emerge better from this crisis.

It could be an interesting chain of considered to picture an interplay of semantic website, digital signing and electronic digital authentication.

Banks can level Banking as a Service faster due to increased digitalization, usage of APIs and automation in the banking industry.

In addition, several leading fintech firms like Plaid are traveling significant changes in customer targets related to data and account information portability.

This plays vital purpose in increasing Banking as a Service projects also it modernization across financial institutions.

It functions as an electronic banking service on the market on-demand; hence it really is exceptionally ideal for small organizations that don’t have enough resources to go through the long and

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Best Gdp Episode

Best Gdp Episode  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500