Binance USD: USD backed stablecoin that balances US currency with decentralized blockchain technology.

USDC is part of a global ecosystem that spans traditional and crypto commerce.

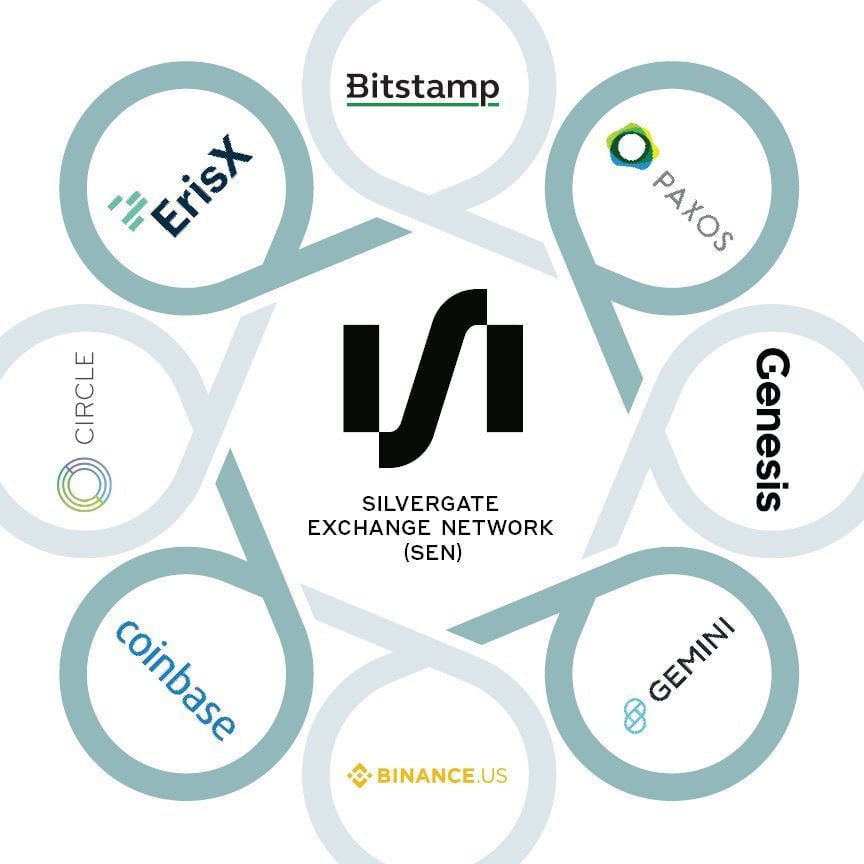

Developed by Circle, a regulated fintech, USDC is really a trusted, widely accepted, and highly liquid digital dollar.

Say goodbye to

- Regulators also have emphasized the significance of safety of trading platforms.

- Stablecoins offer some distinct benefits over their traditional counterparts due to blockchains being the underlying mechanism facilitating the transfer of value instead of opaque, outdated, and manual processes.

- The partnership entails Paxos holding the same as fiat USD in reserve for each and every BUSD stablecoin in circulation.

- USDT tokens do not require outside banks to use, making them easier to manage and transfer.

- volume for USDT is approximately $83 billion, while BUSD is just about $12 billion.

- Ledger gives you the keys to be your own bank, providing full control and self-custody over your assets.

reserve-backed stablecoin, and TITAN, the governance token for the IRON Finance protocol.

The remaining fraction of existing public stablecoins use other mechanisms to stabilize their price instead of counting on the soundness of underlying reserves.

Other trusted reserve-backed USD-pegged public stablecoins with varying degrees of financial audits include USD Coin, Binance USD, TrueUSD, and Paxos Dollar.

1 USDC is backed by the same value folks dollar denominated assets held as reserves for the advantage of USDC holders.

The portfolio of the Circle Reserve Fund, which consists today of short-dated US Treasuries and cash, is custodied at THE LENDER of NY Mellon and is managed by BlackRock.

Us Executive Order And Sec Take Steps Toward Crypto Regulation

As the US dollar continues to be the world’s reserve currency and strongest fiat currency, it shares the same sentiment of being a stable and reliable substitute for store one’s value.

BUSD offers a monthly audited report of reserves in compliance with stringent regulatory standards to ensure the security of user assets.

USD Coin is a stablecoin fully backed by the united states dollar and developed by the CENTRE consortium.

Twitter user astromagic identified a trade for $250k made by Alameda to swap USDT to USDC.

The trade appears to be a part of a more substantial technique to short USDT to the tune of several hundred thousand Dollars.

While the figure may seem inconsequential given how big is the crypto industry, it begs the question of why Alameda is making this type of trade at the moment.

Forkast.News is a digital media platform that covers stories about emerging technology at the intersection of business, economy and politics.

To make a new revenue stream, STEPN setup its own decentralized exchange, DOOAR, in July.

Wyoming, which has led the United States on regulation for blockchain and cryptocurrency, recently codified rules for DAOs residing in the state.

A DAO could, therefore, be created beneath the laws of hawaii of Wyoming.

Binance Will Convert

As many countries all over the world have unreliable currencies, BUSD and other stablecoins have grown to be a safe haven for people looking to climb out of poverty.

The question for central banks and regulators then becomes which combination of the three approaches can also improve competition, lower cost, and increase access to the financial system.

While it may be tempting to preserve the status quo, such an approach is unlikely to deliver exactly the same benefits.

As with narrow banks, the economic great things about true stablecoins could be … narrow.

- Platforms must also comply with AML obligations and acquire an Information Security Management System certificate from the Korea Internet & Security Agency .

- As an electronic dollar with global reach, USDC could be available whenever and wherever you will need it.

- The best aspect of stablecoins is clearly evident within their name, i.e., ‘stability.’ They can play and are playing an essential role in driving the adoption of cryptocurrency.

- The regulatory framework is expected in 2022 and comes as a reply to major crypto scams where investors have already been defrauded.

Centralized stablecoins effectively allow for value pegged to fiat currencies to move globally between wallets with no need for intermediaries to facilitate the transfer.

Decentralized stablecoins are generally overcollateralized by on-chain cryptocurrencies and require price data to keep up full collateralization (e.g. a user’s collateral will probably be worth greater than a certain percentage of their loan’s total value).

The digital currency can’t be used to cover any goods and services, however.

The Iranian Central Bank has authorized banks and currency exchanges to utilize crypto-currencies mined by licensed crypto miners in the county.

Token Unlocks Estimates $102b Worth In Locked Up Assets

New research demonstrates decentralized finance protocols specifically are becoming an extremely significant route for the money launderers.

The January 2022 update from data provider Chainalysis reported that $8.6 billion worth of cryptocurrency was laundered in 2021 — a figure that has fluctuated from $6.6 billion in 2020 to $10.9 billion in 2019.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Best Gdp Episode

Best Gdp Episode  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500