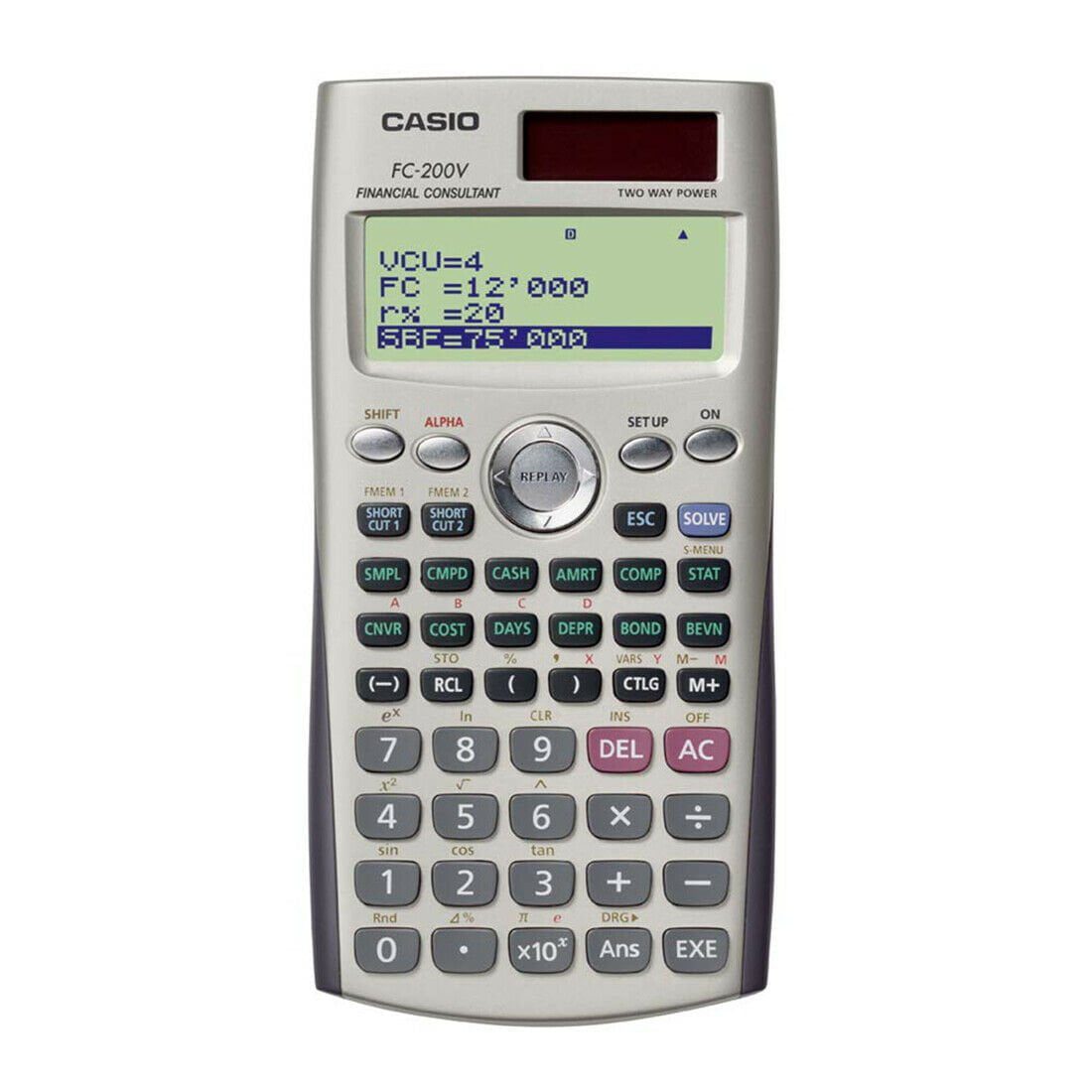

Cf Financial Calculator

Financial Calculators

Which means that the present value of the amount flows decreases. Now, this particular is not constantly the situation, since cash flows typically are usually variable; however, we must still account for time. The way we do this particular is through typically the discount rate, l, and each cash flow is discounted from the number of time durations that cash movement is away from the current date. Because of this our own cash flow for the first time period of the particular project would become discounted once, the particular cash flow in the second time time period would be discounted two times, etc. To lower price a cash movement, simply divide the particular cash flow by one plus typically the discount rate, brought up to the number associated with periods you might be discounting. Finally, discover the discount rate that translates the initial price of the investment with all the future value associated with the cash flows. This discount rate will be the MIRR, in addition to it can be interpreted as the compound average annual rate of return that you will certainly earn on a good investment in case you reinvest the cash flows at the reinvestment rate.

Take for instance, a rental property that produces rental income of $1, 000 per month, a new recurring income. Traders may wonder what the cash circulation of $1, 000 each month for 10 years is worth, in any other case they have zero conclusive evidence that will suggests they should invest so many money in to a rentals property.

Obtain A Consolidated Overview Of Your Standard Bank Account, Credit Playing Cards, Loans, And Investments In One Spot

Understand that at period 0 you must outlay $500, 500 in order to receive the new piece of machinery, in addition to the following years you will obtain cash due in order to an increase within production of icons. Now that we have got a good visible of what the particular project looks such as financially, let’s arranged up our equation. The time value of money program operates on the convention that money put in is considered good and money withdrawn is considered unfavorable. An analysis of the monetary circumstance should indicate which usually values are now being spent and which values are being withdrawn. This will figure out which can be entered since positive values in addition to which are entered as negative values. Within addition to arithmetic it can furthermore calculate present value, future value, payments or number or periods.

Suppose a person since the investor are weighing two various potential investments, the two of which can favorably help your business. A person are hoping that will, over a three-year period, a new piece of machinery will allow your own workers to create widgets more proficiently, but you are not sure which fresh machine will end up being best. One device costs $500, 1000 for a three-year lease, and an additional machine costs $400, 000, also to get a three-year lease. You would like to calculate the IRR for each project to help determine which usually machine to buy. If we consider things intuitively, in case one project includes a higher IRR, then it must generate better cash flows, we. e. a greater numerator must end up being divided by a greater denominator, and therefore IRR, given exactly the same preliminary costs. We can likewise think of the IRR as typically the expected compound price of return regarding a project.

Business & Financing Calculator

We should solve this formula again by typically the “plug and chug” approach. Let’s once again start with 20% as our rate simply to see exactly where we stand. When we work through our calculations, we all get an NPV of $254. 63, which in typically the scheme of items is very close to zero.

As another example, what regarding the evaluation associated with a business of which generates $100 inside income every year? How about the transaction of any down transaction of $30, 500 and a regular monthly mortgage of $1, 000? For these types of questions, the transaction formula is quite complex therefore it is best left in the particular hands of our own Finance Calculator, which can help evaluate all these situations with the particular inclusion of the PMT function. Don’t forget to pick the correct insight for whether payments are made at the starting or end regarding compounding periods; the particular choice has large ramifications on the final amount regarding interest incurred. Inside basic finance programs, lots of moment is spent about the computation regarding the time worth of money, which usually can involve 4 or 5 different elements, which includes Present Value, Upcoming Value, Interest Level (I/Y), and amount of periods. Premium Payment may be included but is not really a required component.

Internal rate associated with return is a discount rate of which is used inside project analysis or capital budgeting of which makes the internet current value of upcoming cash flows specifically zero. If an individual aren’t quite common with NPV, you may find it better to read by means of that article initially, as the formula is exactly the particular same. The difference here is that, rather than summing future money flows, this period we set typically the net present benefit equal to no, and then we solve for the discount rate.

- To low cost a cash circulation, simply divide the cash flow by one plus typically the discount rate, elevated for the number regarding periods you happen to be discounting.

- Now, this is not always the situation, since money flows typically are variable; however, all of us must still account for time.

- This means that the present worth of the money runs decreases.

- The way we do this is through the particular discount rate, r, and each income is discounted from the number of time intervals that cash movement is away from the existing date.

Considering that the period value of money application is not created for these situations, the HP 10bII contains functions that will solve these varieties of problems, frequently referred to as discounted income evaluation. The future value calculator can become used to determine the future benefit of an investment with given inputs regarding compounding periods, interest/yield rate (I/Y), starting up amount, and routine deposit/annuity payment each period. Calculate the particular total present value of each of the cash flows, starting up from period 1 ) Use the calculator’s NPV function merely like we do in Example 3, above. Make use of the reinvestment rate otherwise you lower price rate to get the existing value. In case you estimate a positive NPV, try increasing your own rate, and if you calculate the negative NPV, try out decreasing your level.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Best Gdp Episode

Best Gdp Episode  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500