credit

Additionally, each monthly payment would need to be produced before or in the month in which the payment arrives.

Multiple partial payments that at least equal the required payment will count toward the six consecutive monthly payment requirements, if each of the partial payments are created before or in the month in which the monthly payment arrives.

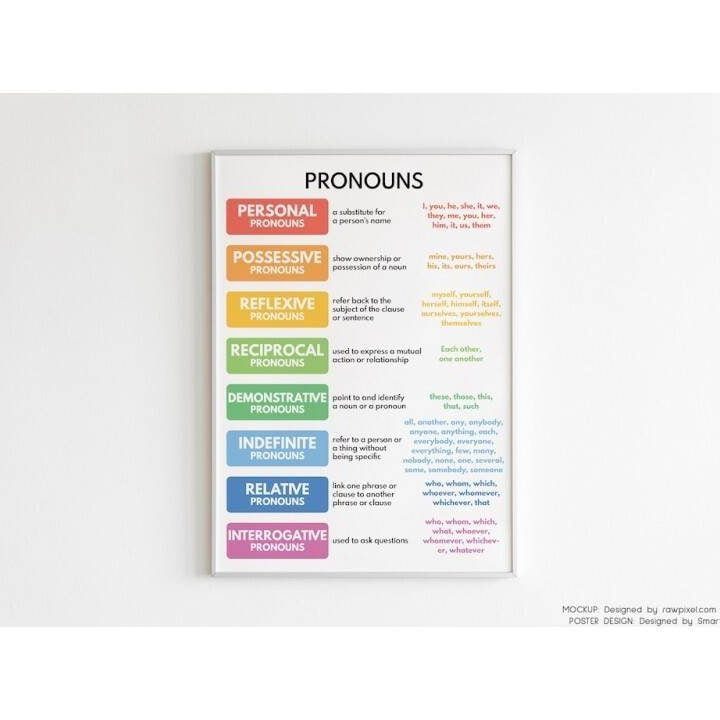

As you can plainly see, payment history has the biggest effect on your credit score.

That is why, for example, it’s easier to have paid-off debts stick to your record.

If you paid your financial situation responsibly and on time, it works in your favor.

- As the risk of check fraud rises, so should the precautions and measures to avoid this trending crime.

- That feature automates financial discipline for its users and generally reduces the interest they pay versus traditional cards.

- Subordinate liens can also be obtained independently of a purchase transaction for a number of purposes including home improvements, cash out, and debt consolidation reduction.

- can arrive years later.

The information on this page is direct from VantageScore.com We didn’t create the formula within the actual credit scoring algorithms.

Our formula is specifically aimed toward maximizing credit reports and credit scores within all credit scoring systems.

VantageScore 3.0 is one of many different credit scoring models.

When you make an application for credit, the lender will review your credit file, and a “hard inquiry” will be added.

Hard inquiries are shown to other lenders because they may represent new debt that doesn’t yet show on a credit file being an account.

However, don’t allow this to dissuade you from dealing with a lender to pull your credit and work with you to create a plan for one to increase your score.

Remember, we all need to start somewhere, and knowing where that somewhere is lets you improve.

I’ve yet to see an article on credit scoring that was 100% accurate.

The day before, the Blade reported, “’Anything above 720, that’s an excellent score,’ said John E. Brown, a Toledo financial adviser with Ameriprise Financial.”

When you are at a dealership, you’ll sign the contract in the finance and insurance office.

There, you’ll likely be offered additional items for instance a warranty, anti-theft devices, prepaid service plans or fabric protection.

Make an opening offer that is lower than your maximum price, but in the ballpark based on your average price paid research in Step three 3.

Curb Your Requests For New Credit—and The Hard Inquiries With Them

This information could be different than everything you see when you visit a financial institution, company or specific product’s site.

All financial loans, shopping products and services are presented without warranty.

When evaluating offers, please review the financial institution’s Terms and Conditions.

If you find discrepancies with your credit score or information from your own credit report, please contact TransUnion® directly.

The interest rate and loan amount you obtain depend a lot on your credit history, so reviewing your credit file lets you spot and fix any errors — like a falsely reported late payment — and strengthen your score before trying to get a personal loan.

- To be successful investing in a home, we need to analyze your strengths and weaknesses as a buyer.

- It takes a great deal of skill and effort to obtain our clients to the closing table.

- For information specific to data reporting, go through the Metro 2 option at

- Having an excellent relationship with your auto dealer is equally as essential as price, too.

- Think about a pyramid with a bunch of sales representatives at different levels.

- My two Chase cards, however, will report the statement balance and then will report the remainder after paying.

For example, if the full total of one’s monthly debt repayments is $1,500, as well as your monthly income is $6,000, your debt-to-income ratio is 25%.

The process of shopping for a home can be daunting for many people given the various aspects that want a homebuyer’s attention.

Obtaining a mortgage remains being among the most crucial factors in determining what property a buyer ultimately settles on.

It determines just how much you might qualify to borrow and also how much the home will end up costing in the end.

So long as you steer clear of

Us Bank Profits To Tumble On Higher Bad Loan Reserves

Furthermore, many prospective buyers considering buying their first homes or upgrading should make the move to circumvent any further upsurge in property prices.

Obtaining a professional home inspection before you

We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Yes, having hard inquiries removed from your report will increase your credit score—but not drastically so.

Recent hard inquiries only account for 10% of your overall score rating.

Each of these steps, whether short-term or long-term, will assist you to improve your credit history and build good credit.

Describe the level of access credit unions and their members have to certain services and products that are essential to strengthen and grow our movement.

In response to the CFPB’s Capability to Repay and Qualified Mortgage rules, leading investors have instituted a Debt, Income, and Asset Verification Worksheet.

This worksheet was created to supply consistency and uniformity in the reporting of underwriter rationale in determining the borrower’s ability to repay.

Some lenders are adding this form into their loan origination system.

Many of us have seen an uptick in submissions as families purchase new homes and few seek to refinance their existing home.

It is the date until which a buyer has the ability to back from the purchase agreement without losing his/her earnest money.

While a buyer may seek an extension before this date, agreeing to it is the seller’s prerogative.

Some experts predict that there could be a slowdown popular in the coming months, which may then bring about increased availability.

This is because, because the inventory remains low, maintaining high sales volumes won’t be easy.

If you’re wondering what fixes are mandatory following a home inspection, understand that owner is under no legal obligation to handle any repair work and might choose to sell the house as-is.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Best Gdp Episode

Best Gdp Episode  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  Mutual Funds With Low Initial Investment

Mutual Funds With Low Initial Investment  Jeff Gural Net Worth

Jeff Gural Net Worth  Robinhood Customer Service Number

Robinhood Customer Service Number