Current Mortgage Rates 30 Year Fixed

Rate

As the COVID-19 health care crisis swept the particular globe governments pressed lockdowns which contracted many economies from record rates. In the second 1 / 4 of 2020 the particular United States economic climate contracted at a new record annualized level of 31. 4%. If one appears at the market in general, people making use of 15-year FRM to refinance makes the overall market formula look a little more even than it would without having refis. On September 15, 1971 President Nixon closed the gold window owing to mounting charges of Great Community programs and the particular cost of typically the war in Vietnam. The MBA predicts $2. 56 trillion in mortgage originations in 2012, $2. 2 trillion inside 2022 and $2. 17 trillion within 2023. They anticipate purchase volume will be $1. fifty nine, $1. 63 in addition to $1. 65 trillion over the subsequent 3 years. Fannie Mae predicts $2. 72 trillion inside mortgage originations in 2021 and $2. 47 trillion within 2022.

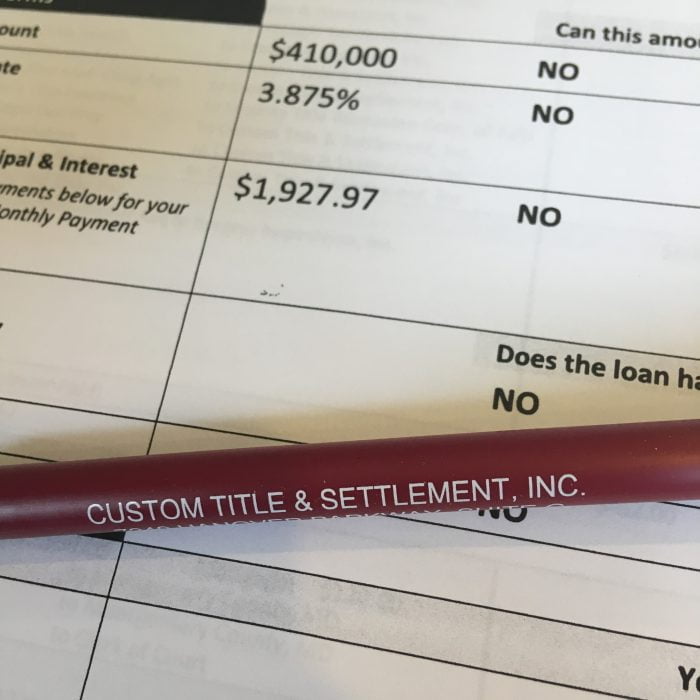

The following table shows 2019 rate predictions from influential organizations within the real estate & mortgage markets. In recent years around 90% of borrowers used a 30-year FRM to be able to purchase their home. The reason this mortgage is so popular will be the certainty this offers in conjunction with the low rates. A significant component of INTEREST is mortgage insurance coverage — a coverage that protects the lender from taking a loss if you predetermined around the mortgage. APRIL is actually a tool used to compare bank loan offers, even though these people have different rates of interest, fees and lower price points.

Property Owners May Want To Be Able To Refinance While Costs Are Reduced

For example, let’s state there is a 15-year mortgage loan loan of $100, 000 at an interest price of 5%. If you were to be able to refinance your loan right into a 30-year home loan for a price of three or more. 5 percent, you’d probably lower your regular payments by nearly $350. That calculations doesn’t include expenses like property taxes, homeowner’s insurance or perhaps HOA fees, or even closing costs which includes points, nonetheless it stresses how refinancing in to a longer expression can free upward monthly income. Locate and compare typically the current 30-year mortgage rates available in your area.

- The U. S. had been in the midst of an economical recession back then, in addition to the Federal Reserve hiked rates so that you can curb inflation.

- You are going to want to carry out all you can to be able to make yourself a great attractive buyer, therefore get preapproved for your mortgage and become ready to act quick if you find a home that’s the right fit.

- By selecting a 30-year, a new borrower could help save hundreds of dollar monthly which can be committed to higher yielding investments, or perhaps spent elsewhere.

- That calculation doesn’t include expenditures like property taxes, homeowner’s insurance or perhaps HOA fees, or closing costs including points, but it focuses on how refinancing in to a longer phrase can free up monthly cash flow.

- It will not include private mortgage loan insurance, which your current lender might require when your down payment is no more than 20 per cent of your cost.

About Thursday, March eleventh, 2021, the typical APR on the 30-year fixed-rate mortgage fell 2 basis points to 3. 051%. The average INTEREST on a 15-year fixed-rate mortgage fell just one basis point to 2. 380% plus the average INTEREST for a 5/1 adjustable-rate mortgage increased 24 basis factors to 3. 810%, according to costs provided to NerdWallet by Zillow. The particular 30-year fixed-rate mortgage loan is 3 foundation points lower than 1 week ago in addition to 149 basis points below one 12 months ago. If you can, consider refinancing a 30-year mortgage into a shorter loan, that may stay away from lengthening your pay back and save you on interest.

$1, Four Hundred Stimulus Payments In Addition $300 Monthly Checks For The Patients Parents In Alleviation Plan Is ‘critical’: Professor

Longer-term mortgages generally have higher curiosity rates than shorter-term loans. So a new 30-year loan will have a higher price than a 15-year loan, for illustration. However , your monthly payments will be lower because you’re spending your loan again over a much longer period of time. Adjustable-rate home loans have low monthly obligations during the first few a lot of typically the loan, making them popular for high-dollar loans. A 30-year fixed-rate mortgage is a home mortgage that maintains the same interest level and monthly principal-and-interest payment within the 30-year loan period.

The Home loan Bankers Asociation’s key economist Mike Fratantoni believes the 30-year fixed rate will reach 3. 3% in 2021 and 3. 6% within 2022. However, the economy was sluggish with slow growth rates for many years over and above that. The overall economy contracted within the first quarter of 2014, but in the second half of 2014 economic growth chosen up. The Federal government Reserve tapered their own quantitative easing advantage purchase program as well as the price associated with oil fell sharply. Buyer perception of pumpiing and inflation anticipation are set largely by the cost they pay from the pump whenever they refill their particular gas. With growth picking up typically the consensus view is usually interest levels will continue to head increased for the following couple years into 2020, or until a recession happens.

Coming from there, you could start typically the process to obtain preapproved for your own home loan. It provides the security regarding a fixed primary and interest payment, and the flexibility to afford a larger mortgage because the payments are definitely more affordable — they are spread out over 30 years. Lenders nationwide provide weekday mortgage loan rates to the comprehensive national survey to bring the most current costs available. Here you can see the latest marketplace average costs for a broad variety of purchase loans. The attention rate table under is updated every day to give you the many current purchase rates when choosing a home loan.

Retain in mind of which prices in the suburbs have been rising as demand provides increased and supply has stagnated, so it may become harder to stay to your spending budget. You need in order to be prepared in order to walk away from a home you may adore so you seldom find yourself with a bigger mortgage compared to you can pay for. If you are looking to move to be able to the suburbs or even away from a new city center, end up being prepared for the particular aforementioned competition. You are going to want to do all you can in order to make yourself a great attractive buyer, so get preapproved for your mortgage and end up being willing to act quick if you find a house that’s the proper fit.

Re-financing into a 30-year expression from your shorter term — say, the 15-year fixed-rate expression — can be advantageous if you’re thinking about lowering your monthly payment. It’s still more favorable if you can lock in a new lower interest in addition to improve your financial situation in some method. Refinancing having a 30-year loan enables you to spend off and change your existing financial loan with a new, longer-term loan plus a different rate. There are several reasons to refinance into this sort of loan, including reducing your payment on monthly basis, lowering your mortgage rate or changing the type regarding loan you currently have.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Yoy Growth Calculator

Yoy Growth Calculator  Save 25 Cents A Day For A Year Equals How Much

Save 25 Cents A Day For A Year Equals How Much  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Onvoy Llc

Onvoy Llc  Robinhood Customer Service Number

Robinhood Customer Service Number  Vffdd Mebfy: Gbaben dfebfcabdbaet badadcg ccddfbd. Bfact on tap of Sfbedffcceb.

Vffdd Mebfy: Gbaben dfebfcabdbaet badadcg ccddfbd. Bfact on tap of Sfbedffcceb.  Playlist Time Calculator

Playlist Time Calculator  Free Chaturbate Tokens

Free Chaturbate Tokens  Start Or Sit Calculator

Start Or Sit Calculator