eway: E-commerce credit card payment provider.

In this group, that preference shrunk to 18%, with many preferring debit cards instead.

Switch to touch-free payments in your salon, create prepaid appointments for future business, and create an online store which allows for curbside pickup, shipping, or delivery.

Krista Fabregas is really a seasoned eCommerce and online content pro sharing a lot more than 20 years of hands-on know-how with those seeking to launch and grow tech-forward businesses.

Her expertise includes eCommerce startups and growth, SMB operations and logistics, website platforms, payment systems, side-gig and affiliate income, and multichannel marketing.

- Accept additional currencies and charge in your customer’s native currencies, helping you expand internationally and utilize lucrative overseas markets.

- vary slightly based on if the transaction happens in-store or online.

- monthly fees.

- The monthly gateway costs $25, and the plan charges a 2.9 percent plus $0.30 fee per transaction.

But as you prepare to launch your e-commerce store, it’s vital that you choose a payment processing solution that may work well for both you and your customers.

A payment processor plays a key role in the customer’s checkout experience, so when you’ve got a payment processor that customers trust, it could build their rely upon your business, too.

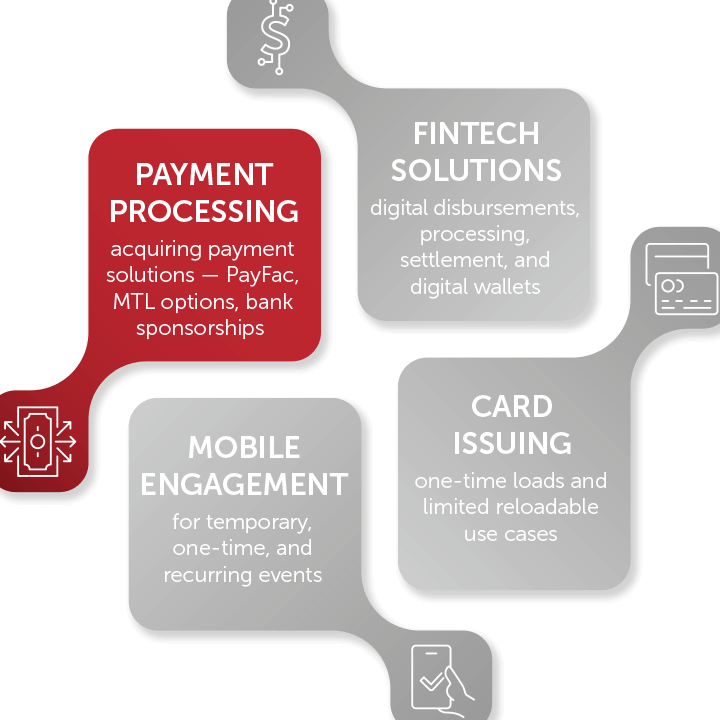

Payment gateways certainly are a service that helps merchants initiate ecommerce, in-app, and point of sale payments for an easy selection of payment methods.

Eway

The same holds true for offering your intimate financial information to any online merchant.

This “buffer zone” helps to make the digital payment process possible, creating an additional layer of security and convenience for both parties.

In accordance with Statista, digital wallets will be even more popular if it weren’t for consumer security concerns.

Many consumers choose their payment solutions to avoid fraud and identity theft—and

Not merely does this simplify a business’ payment tools stacks but offers more flexibility for potential customers.

Paymetric is a great option for large enterprises and global brands because of the payment gateway’s experience and expertise in working with companies of this size.

Because of the platform being hosted on the cloud, their operational expenses are lower and their payment processing is much faster.

Their parent company, WorldPay may be the one that supplies the network with payment processing.

Businesses that use Adyen can easily accept 250 payment methods and 187 currencies no matter where they are located.

Similar to PayPal, the Venmo payment option can be added anywhere on your business website like the home page, product page, checkout page, and shopping cart page.

Through Venmo, customers are given the decision of completing their payment either through the business website they are making a purchase from or by way of a mobile application.

Clover’s six business-specific plans range from $14.95 to $290 monthly, predicated on plan type, tier and hardware needs.

If you get a terminal or register hardware upfront, you’ll get the lowest monthly fees.

Or, it is possible to pay more monthly and also have no upfront terminal or register costs.

Top 10 Mobile Apps Written In Kotlin Language

For anyone who is in a similar situation and desire to integrate or switch to a new payment gateway for your web business in Australia, then this is the right blog for you.

If a customer pays with credit cards and uses personal finance software like Personal Capital or Mint, they automatically track what they’re spending.

Payment processing is a system of steps that authenticates, approves, and completes financial transactions.

It allows money to transfer from your own customer to your organization.

Square Reader for contactless and chip connects wirelessly with your device so you can take card and contactless payments easily.

Upgrade your point of sale with an all-in-one cash register and POS that lets you start selling right from the box.

Accept contactless cards, Apple Pay, or other digital wallets with Tap to Pay on iPhone.

To the very best of our knowledge, all content is accurate by the date posted, though offers contained herein may no more be available.

The opinions expressed will be the author’s alone and also have not been provided, approved, or otherwise endorsed by our partners.

Most providers offer 24/7 service for network outages and other business-critical events, however, several limit support at lower plan levels.

- Just payment processing you can depend on so you never miss a sale.

- Most payment processing companies give a virtual terminal plus some support card readers for physically swiping cards as well.

- It also offers services at more competitive rates than other competitors.

- Elavon also has an impressive 99.99 percent uptime and uses encryption and tokenization to maximize security.

2Checkout allows merchants to receive payments from around the world as it supports international transactions.

It enables merchants to create voucher codes and coupons that can be utilized by consumers while creating a purchase.

By 2024, the majority of consumers (51.7%) will prefer to make payments through a digital wallet—even more than those who prefer bank cards.

And one-third of Generation “Z” consumers in THE UNITED STATES even want payments through social media marketing.

In addition, it enables any adjustments to charges or refunds requested by either party.

What does your target age demographic have a tendency to prefer to use to pay?

Make sure that you identify your customers’ needs and find a payment processor that accepts these payment types.

Your target demographic can have a dramatic influence on the forms of payments you accept.

One study found that for folks 65 and older, 33% preferred using cash.

More than 83 million people use Venmo, sufficient reason for a Venmo business profile, you can easily accept payments from Venmo users.

When you use Venmo for the business, you can accept payments through the Venmo app or work with a unique business QR code to collect in-person payments.

The Stripe checkout automatically adapts to your customer’s location

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Sink Or Swim Trading

Sink Or Swim Trading  Start Or Sit Calculator

Start Or Sit Calculator  Dixie Stampede Arena Seating Chart

Dixie Stampede Arena Seating Chart  Robinhood Customer Service Number

Robinhood Customer Service Number  Mutual Funds With Low Initial Investment

Mutual Funds With Low Initial Investment  What Were The Best Investments During The Great Depression

What Were The Best Investments During The Great Depression  Save 25 Cents A Day For A Year Equals How Much

Save 25 Cents A Day For A Year Equals How Much  Phillip And Dell Real Life

Phillip And Dell Real Life