How To Calculate Monthly Growth Rate In Excel

Month

In this example, we’ll look at how to make a RATE formula in its simplest form to calculate interest rate in Excel. Nper – the total number of payment periods such as years, months, quarters, etc. Financial decisions are an important element of business strategy and planning. In everyday life, we have quite a lot of financial decisions to make also. For instance, you are going to apply for a loan to buy a new car. It will surely be helpful to know exactly what interest rate you will have to pay to your bank.

With this method, the value for each period DOES matter, because each value affects the average growth rate that the fitted curve displays. If you sell the stock at the end of that time, the CAGR represents the annual growth rate of your investment from the beginning to the final end. Hi i want to calculate the approximate yearly growth rate based on 9 months of data, plus calculate the increase in traffic then.

What The Heck Is An Excel Database?

While using the excel growth formula, we have to be careful while writing the formula correctly. If we input the wrong syntax, we will not get the correct result. Keep the below-mentioned points in mind while using the function Hence. We have a sample data which shows months and their corresponding revenues.

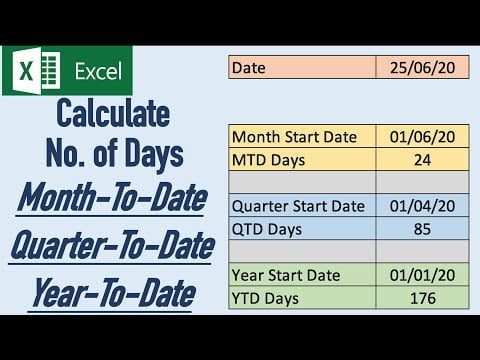

So for an annual growth rate of 5% we would take the approach that follows. Since most installment loans monthly are paid, it may be helpful to know a monthly interest rate, right? For this, you just need to supply an appropriate number of payment periods to the RATE function. Excel offers at least two ways to calculate the periodic growth rate that column D and the red line represent. That is, the ending value is equal to the beginning value times one plus the annual growth rate taken to the number-of-years power. Then, to find the annual growth rate, you take that value to the power of 1 divided by the number of years for which you held that investment. If you search the web to learn how to calculate a compound growth rate in Excel, you’ll likely find instructions for calculating only one type of growth rate.

What Is Month

Notice that you do NOT multiply the monthly rate in cell D20 by 12. Instead, you take 1 plus the monthly rate to the 12th power, and then you subtract 1. You should take the same approach whenever you convert monthly growth rates to annual growth rates.

We will now estimate the revenue for the month of December using Growth formula in excel. What monthly recurring revenue is to the business team, monthly active users is to the product team.

We use the exponential option from the graph trend line option. Let’s understand how to calculate GROWTH in excel with some examples.

- In this post we will explore the correct way to convert growth rates for all periods.

- Instead, you take 1 plus the monthly rate to the 12th power, and you subtract 1 then.

- The Average annual growth rate is the average increase of an investment over a period of time.

- The RATE function in Excel can also be used for calculating the compound annual growth rate on an investment over a given period of time.

- The most common error I see in financial models as it relates to growth rates is to divide an annual growth rate by 12 to arrive at the monthly growth rate.

- Notice that you do NOT multiply the monthly rate in cell D20 by 12.

Column A should contain a list of every year you’ve had the investment. In the first available cell of Column A , type “Initial Value” or something similar. To calculate the difference as a percentage, we subtract this month’s value from last month’s, and divide the result by last month’s value then. To get started, let’s calculate the increase of one value over another as a percentage. Highlight C3 and then point your mouse over the bottom right corner of the cell and the cursor will change to a small black cross-hair . When you see that, click the right button on your mouse, and while holding that down, drag down until you get to the bottom of your data.

In the image below, you can see last month’s value of 430 in cell B3, and this month’s sales of 545 in cell C3. That will put the values and dates into columns A & B respectively. To get an annual interest rate, per year multiply a periodic interest rate returned by the function by the number of periods. If the stats argument is omitted or FALSE, LOGEST returns an array with two values. The first value is equal to one plus the growth rate; the second value is the y intercept…which is equal to cell D3 in the previous figure.

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  90day Ticker

90day Ticker  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500