Hyperwallet: PayPal payment platform that provides an easy way for companies to pay their employees.

According to European Trade Union Institute survey , 15% of remote professionals in Europe declare that making profits via online platforms plays a part in more than 50% of these annual personal income.

With this in mind, Hyperwallet’s payouts capability helps people have the money they have earned almost instantly, an especially important feature during the current economic downturn.

Instant Cashout via Direct to Debit is Grubhub’s latest step to increase financial stability and flexibility for its drivers and is rolling out to all or any drivers through the entire month of June.

The company initially rolled out Instant Cashout – together with Chase – in 2019, allowing drivers to instantly cash out available earnings straight to their bank accounts.

More than 60 percent of drivers currently use Instant Cashout as their primary or partial method of getting funds, and drivers use the feature three times per week on average.

- In 2015, Hyperwallet made a decision to concentrate on the B2B/B2C payout market, closing its C2C remittance platform.

- ACI Worldwide VP of Merchant Payments for Europe Andy McDonald discusses the continuing future of real-time payments.

- Mass payout platform Hyperwallet has teamed up with Lyric Financial, a financial services provider specializing in royalty advances and loans for musical artists.

The claimants accused PayPal of deliberately failing to notify its customers that ICC-Cal was illegally charging them for currency conversion fees.

PayPal discontinued payments to Pornhub models on November 14, 2019, alleging that “Pornhub has made certain business payments through PayPal without seeking our permission”.

Pornhub criticized the decision as one that affected “over a hundred thousand performers who use them for his or her livelihoods”, and steered its payees toward other payment options.

By 2016, ConsumerAffairs had received over 1,200 consumer reviews of PayPal, resulting in an overall satisfaction rating of 1 star out of five for the company.

Consumers also have launched numerous anti-PayPal Facebook pages and Twitter accounts to air their complaints.

In August 2013, entrepreneurs who had used PayPal to get the funds they raised on crowdfunding platforms like Kickstarter and Indiegogo reported difficulty in having the capacity to withdraw the money.

Indonesia.

As early as 2001, PayPal had substantial issues with online fraud, especially international hackers who have been hacking into PayPal accounts and transferring small amounts of money out of multiple accounts.

Standard solutions for merchant and banking fraud might use government criminal sanctions to pursue the fraudsters.

But with PayPal losing huge amount of money each month to fraud while experiencing difficulties with using the FBI to pursue cases of international fraud, PayPal developed a fraud monitoring system to detect potentially fraudulent transactions.

This development of fraud monitoring software at PayPal led Peter Thiel to generate Palantir, a big-data security company whose original mission was to “reduce terrorism while preserving civil liberties.”

Businesses Can Now Accept Venmo As A Way To Pay Within Third Party Apps

PayPal is available in Israel but isn’t available in the Palestinian territories.

Nor can Palestinians employed in the West Bank or Gaza access it but Israelis surviving in settlements in the West Bank can use PayPal.

This decision has prompted Palestinian tech companies to get a policy change from PayPal.

By March 2011, PayPal has made changes to the User Agreement for Indian users to adhere to Reserve Bank of India regulations.

However, on July 29, 2013, PayPal increased the per transaction limit to USD $10,000.

This brings the per transaction limit for India in line with the restrictions imposed by PayPal in most other countries.

- The machine was very appealing to auction sellers, the majority of that have been individuals or small businesses that were unable to accept bank cards, and for consumers as well.

- [newline]A look at some of Hyperwallet’s recent moves gives a good notion of why he’s got that outlook.

- Currencycloud unveils Global Collections make it possible for customers to receive cross border payments with less cost and less friction.

- In 2018, PayPal and Safaricom collaborated to enable Kenyans to execute MPESA transactions by leveraging on the latter’s mobile money service.

In July 2017, PayPal announced a partnership with Baidu, to permit the Chinese firm’s 100 million mobile wallet users to make payments to PayPal’s 17 million merchants through the Baidu service.

PayCargo is a financial platform for moving money and vital remittance information between payers and vendors.

PayCargo’s online solutions allow users to go cargo quicker and reduce payment costs a lot more than any other platform available.

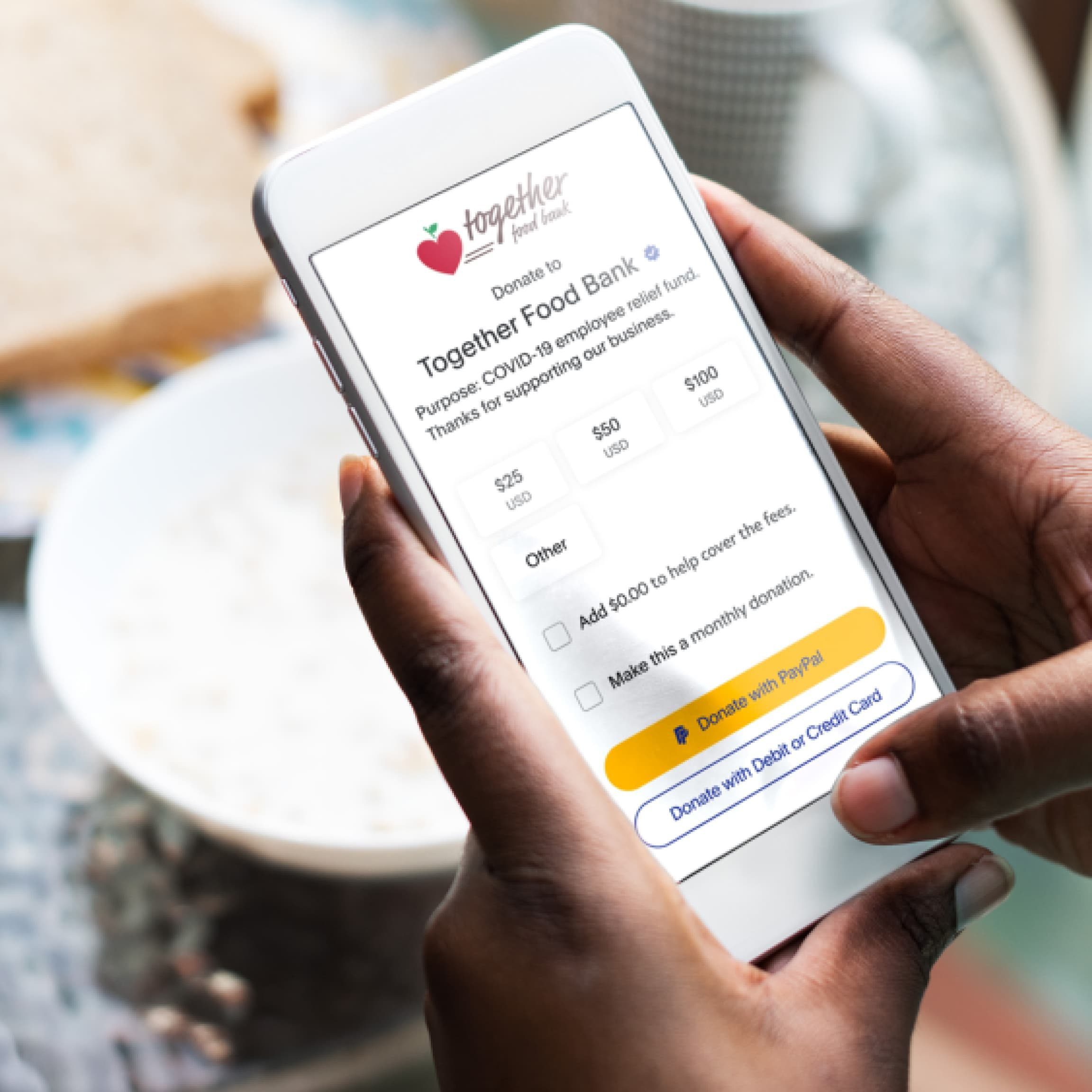

Whether you’re sending payouts to 10 payees or 10,000, PayPal can assist you do it quickly, securely, and compliantly.

From fast self-serve payouts for small- and medium-sized businesses, to custom configured marketplace and large enterprise integrations, PayPal’s payout capabilities are made to handle the unique needs of one’s business – big or small.

“We hold working capital in accounts at banks around the world and have local capabilities in over 100 countries,” says Likar.

Paypal Vs Square Fees

Brent Warrington, Hyperwallet’s General Manager, commented on Lime’s “creative business design,” saying that it “provides a fresh, flexible earning opportunity for individuals.” With Hyperwallet, the Juicers get paid every day.

The Hyperwallet deal comes per month after PayPal announced its plans to acquire iZettle, a Swedish firm that delivers mobile card readers along with other payment tools, for $2.2 billion.

That deal also reflects the increasing importance of gig and freelance work to the bigger economy — a market where payments companies are striving for bigger shares.

As the PYMNTSGig Economy Indexshowed, nearly 40 percent of the American workforce now makes at the very least 40 percent of their income via gig work, and those jobs have gone far beyond rideshares and the like.

It’s perfect for a small business of any size in both virtual and in-person payment space.

The Square debit card is absolve to order and has no monthly fees, minimum balance fees, overdraft fees, or any other recurring fees.

The platform works with most internationally-issued cards with a Visa, MasterCard, AMEX, Discover, JCB, or UnionPay logo.

When you compare Square vs PayPal, neither have any administration fees to speak of.

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to greatly help your team find their next technology solution.

Our new payout methods enable you to access your payments faster than ever before, and integrated payment tracking tools supply you with an increase of visibility into your funds balance.

Samsung Launches Smartthings Station To Raise Your Smart Home Experience

The technology quickly transmits the lender data to the card reader, which after that it sends to the Square software.

The essential Square account is free and comes with a charge card reader that plugs into your mobile device.

Any monies a business receives will sit in your PayPal account where it could be useful for e-commerce, point of sale , or used in a bank account.

The PayPal balance can also be topped off anytime with a bank account or assigned card.

Founded way back in 1998, PayPal can be an online payment system that supports 100+ currencies.

It’s headquartered in San Jose, CA, and provides millions in financial support to nonprofits and charities worldwide.

This two-factor authentication is supposed to make it difficult for a merchant account to be

IndusInd Bank launches Dynamics-powered, interactive charge card with buttons.

Daon to fuel security element of CTMS’ KYC and onboarding solutions targeted at banks in France. [newline]A look at a few of Hyperwallet’s recent moves gives a good idea of why he’s got that outlook.

In March, for instance, Hyperwallet signed a deal withLyric Financialto enable faster and much more efficientroyalty payment advancesto recording artists working onTuneCore.

On the other hand, the Square platform sends members free hardware that may do everything from scanning barcodes to processing refunds and inventory management.

For online and in-store consumer transactions without currency conversion, PayPal is free.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500