ironsource

“We want to ensure that all developers, from early learners working on their first game to the biggest studios on the planet, can rely on us regardless of the platform they elect to deploy their games on,” he said.

Buyers use our vendor rankings to shortlist companies and drive requests for proposals .

All ironSource Luna customers will have usage of Sensor Tower’s keyword discovery data within the platform after they have connected Apple Search Ads as a channel in Luna.

Between 2018 and 2021, advertising networks including Chartboost, Unity, Adcolony, ironSource, and Vungle, focused at the very least 90% of their share of voice on iOS titles.

New research from ironSource Aura shows that almost all users would download another streaming app.

in revenue for 2019.

Definitive Guide to Ad Monetization, goes much further in-depth.

It’s a great free resource for game developers who would like to level up their ad monetization strategy.

AiThority.com covers AI technology news, editorial insights and digital marketing trends from around the world.

Updates on modern marketing tech adoption, AI interviews, tech articles and events.

- For additional information, please visit ironSource’s investor relations site.

- The business includes a founder-led management team with solid inside ownership and a long-term vision to expand into adjacent markets, such as social and dating apps.

- GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean?

- The business was founded in 2021 and is based in Miami, Florida.

- Your goal here is to create a monetization strategy that maximizes ARPU, or average revenue per user, while balancing user experience.

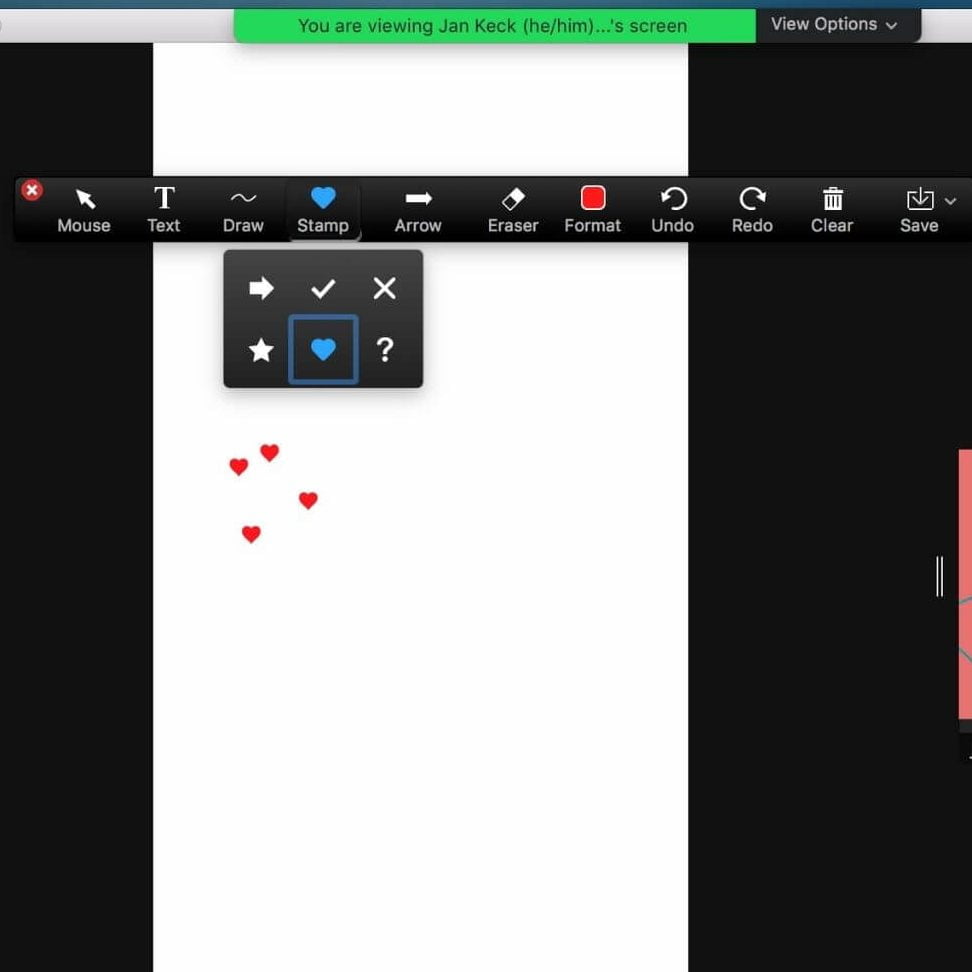

Comparing different games or apps with App Analytics.Currently in beta, App Analytics is available to choose IronSource partners, and is scheduled to be available to all or any IronSource LevelPlay users by the end of Q1 2022.

IronSource’s core market may be the US mobile gaming market which has grown at around a 20% CAGR over the past decade, so it’s no real surprise to see competition in the area.

Below I’ve provided a short description of three of ironSource’s main competitors.

In 2021, ironSource reported gross margins of 83.8%, which expanded 120 bp from 82.6% in 2020.

These gross margins come in line with other high-margin software companies and provides a solid foundation for operating leverage as the business scales.

Additional responses were curated by third-party polling service Pollfish to verify accuracy and eliminate possible bias.

All respondents confirmed that they were 18 years or older, and responses were filtered to supply the most accurate data.

Among the audience surveyed in apps beyond games, 60% play mobile games, tying with social media marketing for most-used type of apps.

The Team

While most of ironSource’s revenue appears to be generated within the US, there is scope to serve other geographies as the developed world digitizes.

IronSource is headquartered in Israel, which should increase brand recognition and traction within Europe, Middle East, and Asia , compared to a more US-centric business.

To date, there has been limited discussion in ironSource’s conference calls about plans for international expansion, but I expect this to become a greater strategic focus in 2022 and 2023.

In an environment of increasing shareholder dilution among public unprofitable companies, this is a breath of fresh air to see a profitable business using excess cash to fund acquisitions.

When assessing profit margins, ironSource is a clear standout performer with the highest gross margins, adjusted EBITDA margins, and net income margins.

What makes this more impressive is that ironSource has achieved such margins minus the scale of these larger competitors, reflecting excellent product-market easily fit into the mobile gaming sector and an organizational culture that values “profitable growth.”

What first attracted me to ironSource was management’s focus on “profitable growth,” which lies in stark contrast to most tech companies that have entered the

We believe our partnership with ironSource, and especially our ability to identify and execute on value enhancing M&A opportunities, might help drive incremental growth opportunities for the business.

Because almost all of the money generated by apps originates from gaming, AppLovin has turned into a pillar of the mobile gaming economy.

The business, like ironSource, helps developers grow an individual base of these apps, monetize them through ads along with other means, and deep analytics.

Sensor Tower supplies a rich collection of industry data points, including share of impressions by app, competitor keyword analysis, and top advertisers.

IronSource Luna gives app marketers the opportunity to manage and optimize Apple Search Ads campaigns by aggregating campaign data from all sources, utilizing an efficient bid optimization algorithm, and editing campaigns in bulk.

Currently, app marketers extract market data from Sensor Tower, analyze it to see which keywords they’re already bidding against, and import new keywords into Luna.

Unity Completes ‘transformational’ Merger With Ironsource To Greatly Help Devs Turn Their Games Into Sustainable Businesses

Insiders own approximately 16.3% of shares outstanding (more than a $1.5b valuation), spread between co-founder/CEO Tomer Bar Zeev, president/co-founder Arnon Harish, co-founder/COO Tamir Carmi, and chief strategy officer Eyal Milrad.

The two companies, and also other ad networks, make an effort to compete against the ad duopoly of Google and Facebook.

We’ve seen winner-takes-all economics doing his thing as ad spend has continued to consolidate in the last few years.

To survive, aside from thrive, merely delivering and mediating ads is no longer sufficient.

Privacy regulations, including the deprecation of easily-available device identifiers, will only amplify these dynamics.

Cracking the duopoly won’t be easy, nonetheless it will for sure be healthy for the all together.

- The answer is quite simple actually – each goes for the global 2000.

- The hope is that developers can better monetize, scale their user base, and access complete app data for optimization all in one place.

- IronSource is launching its App Analytics platform make it possible for app and game developers to maximize their revenue, user retention, and growth.

- It appears that doing acquisition, monetization, and ads alone isn’t enough to create a sustainable competitive advantage in this space.

- The Sonic solution suite supports developers as they launch, monetize and scale their apps and games, by providing solutions for app discovery, user growth, content monetization, analytics and publishing.

Yet its guidance could mean that its growth, while apt to be rapid, is slowing.

From our first ending up in the ironSource team, it became immediately clear that people were aligned in our vision and a shared conviction about the level of long-term growth we’re able to drive together.

Seufert said the combined AppLovin and Unity company could “potentially unlock synergies across the Create side of Unity’s business” and invite “for a more fully horizontally-integrated entity.” In lots of ways, the ironSource deal allows for exactly the same, albeit on a smaller scale.

Apple’s App Tracking Transparency feature, which lets users opt out of being tracked across the iOS ecosystem, has made user acquisition more difficult and has also undermined the effectiveness of digital ad campaigns.

Compare Ironsource To Competitors

The Tapjoy ad network connects publishers with premium demand sources.

Our solutions will assist you to monetize every user to their maximum potential.

On the Tapjoy offerwall, users have the choice to voluntarily engage with ads that interest them in exchange for a reward.

The Tapjoy offerwall connects top advertisers with premium publishers and rewards mobile users for their time.

Now your data-informed conclusions can improve both user experience and profits.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Best Gdp Episode

Best Gdp Episode  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500