Standard Deviation Vs Volatility

Atr, Volatility And Common Discrepancy” Virtus Wide Range’s Blog

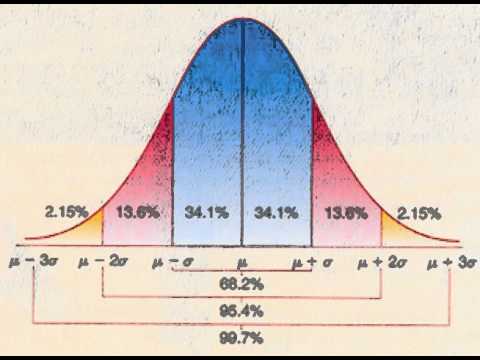

It reveals the extent to which the private data factors in an information collection differ from the mean. In investing, a big common deviation suggests that even more of your information points differ the norm, so, the financial investment will certainly either outperform or underperform comparable safeties. A small typical variance indicates that even more of your data factors are clustered near the standard as well as returns will certainly be closer to the expected results. Z-scores use experts a way to contrast information versus a norm. A given company’s monetary details is a lot more purposeful when you know just how it contrasts to that of other, similar business. Z-score results of no indicate that the data point being examined is exactly average, positioned among the norm. A score of 1 indicates that the information are one common discrepancy from the mean, while a Z-score of -1 places the data one standard variance below the mean.

Difference is a measure of the dispersion and also is not bound by at any time period. On the various other hand, volatility records the level of variation of a time series with time.

What Is The Difference Between Volatility As Well As Variation?

The worth of annually’s return less the mean is 21.2%, -21.2%, -6.5%, 29.6%, as well as -23.3%. All those values are after that made even to yield 449.4, 449.4, 42.3, 876.2, and also 542.9, specifically. The variance is 590.1, where the settled worths are added together as well as divided by 4. The square root of the variation is required to obtain the typical variance of 24.3%.

Determine the everyday volatility and yearly volatility of Apple Inc. throughout the period. Capitalists expect a benchmark index fund to have a low typical discrepancy. Nevertheless, with growth funds, the discrepancy should be greater as the monitoring will certainly make aggressive moves to capture returns. Just like other financial investments, greater returns equate to higher financial investment risks. Basic variance is essentially a reflection of the amount of irregularity within a provided information set.

Why Volatility Is Necessary For Capitalists.

As a disadvantage, the common variance calculates all unpredictability as danger, also when it’s in the investor’s support– such as above typical returns. Historic volatility is a statistical step of the dispersion of returns for a provided protection or market index recognized over an offered amount of time. For instance, in a stock with a mean cost of $45 as well as a conventional deviation of $5, it can be thought with 95% certainty the next closing cost remains in between $35 and also $55. However, cost plummets or spikes beyond this array 5% of the moment. A stock with high volatility typically has a high typical inconsistency, while the variance of a stableblue-chipstock is typically relatively low. While common variance is a vital measure of financial investment threat, it is not the only one. There are numerous various other steps investors can use to identify whether an asset is also high-risk for them– or not high-risk sufficient.

- An annualized one basic discrepancy of stock prices that gauges how much past stock prices differed their standard over an amount of time.

- Simply calcluate the weekly percentage modification and take the basic variance of that data.

- To annualize the weekly volatility, you ‘d simply need to multiply by the square origin of 52, since there are 52 weeks in a year.

The greater the Z-score, the additional from the norm the information can be taken into consideration to be. The Z-score, or common score, is the number of basic discrepancies a provided data point lies over or below the mean. The mean is the standard of all values in a team, added together, and afterwards separated by the overall variety of items in the team.

On the various other hand, when there is a slim spread between trading varieties, the standard variance is reduced, indicating volatility is low. Unstable rates imply common variance is high, and also it is reduced when costs are reasonably calm and exempt to wild swings. When rates relocate hugely, standard inconsistency is high, suggesting an investment will be risky. Understanding the chance that a safety– whether you buy stocks, alternatives, or common funds– moves in an unexpected means can be the difference in between a well-placed trade as well as personal bankruptcy.

Why Volatility Coincides As Basic Deviation

The term “volatility” refers to the analytical step of the dispersion of returns during a certain time period for supplies, protection, or market index. The volatility can be calculated either making use of the conventional deviation or the variation of the safety or stock. Standard variance is a statistical dimension in finance that, when applied to the yearly rate of return of a financial investment, clarifies that financial investment’s historic volatility. The greater the conventional deviation of safety and securities, the better the variation in between each price and also the mean, which shows a bigger cost array.

The typical deviation is a fact that determines the diffusion of a dataset about its mean as well as is computed as the square root of the variance. The conventional inconsistency is computed as the square root of variation by identifying each data point’s variance relative to the mean. If the data factors are additionally from the mean, there is a higher variance within the information collection; therefore, the more spread out the information, the greater the standard deviation.

The variance aids establish the information’s spread size when contrasted to the mean value. As the variation grows, a lot more variant in data values happens, and there may be a larger gap in between one data worth and an additional. If the data values are all close together, the difference will certainly be smaller sized. Nonetheless, this is more difficult to comprehend than the conventional deviation since variations represent a settled result that may not be meaningfully shared on the very same graph as the original dataset. Difference is obtained by taking the mean of the data points, subtracting the mean from each data point separately, settling each of these results, and afterwards taking an additional mean of these squares.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  CNBC Pre Market Futures

CNBC Pre Market Futures  Robinhood Customer Service Number

Robinhood Customer Service Number  Arvin Batra Accident

Arvin Batra Accident  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500