Stock Market Chart 2001

Exactly How September 11 Impacted The U T. Stock Market

At the close of buying and selling that Friday, closing per week that noticed the largest losses in NYSE history, typically the Dow Jones had been down more compared with how 14%. The S&P 500 Index dropped 11. 6%, even though the Nasdaq shed 16%.

Ever since then, Wall Street has done a more satisfactory job of performing due diligence of rising tech companies and largely has avoided a new repeat of typically the crash. “Chinese inventory market beats Stock market and FTSE simply by closing up in 2015”. Reforms contain better disclosure associated with corporate balance sheet information.

Listing Of Stock Market Crashes Plus Bear Markets

Another reason may be the potential earnings stock can gives in the form of payouts if the firm is doing really well. “Online Trading” refers to purchasing & selling financial instruments via world wide web. Whether you are using a computer, an iPad or even a smartphone, you can always get access to typically the financial market with top rated online trading brokers encouraging different devices.

In 2001, the particular DJIA was mostly unchanged overall yet had reached a secondary peak of 10, 337. 92 (11, 350. 05 intra-day) on May twenty-one. This downturn can be viewed as portion of a greater bear market or even correction that began in 2000 after a decade-long fluff market had resulted in unusually high share valuations, according in order to a written report by typically the Cleveland Federal Reserve. Many internet companies (Webvan, Exodus Communications, and Pets. com) went bankrupt. Other people (Amazon. com, eBay, and Yahoo! ) went down considerably in value, yet remain in company to this day and have got generally good extensive growth prospects. A great outbreak of accounting scandals, was also a new factor in the speed of typically the fall, as numerous large corporations were pressured to restate income and investor confidence suffered. The Sept 11 attacks furthermore contributed heavily to the stock market recession, as investors became unsure about typically the prospect of terrorism affecting the United States overall economy.

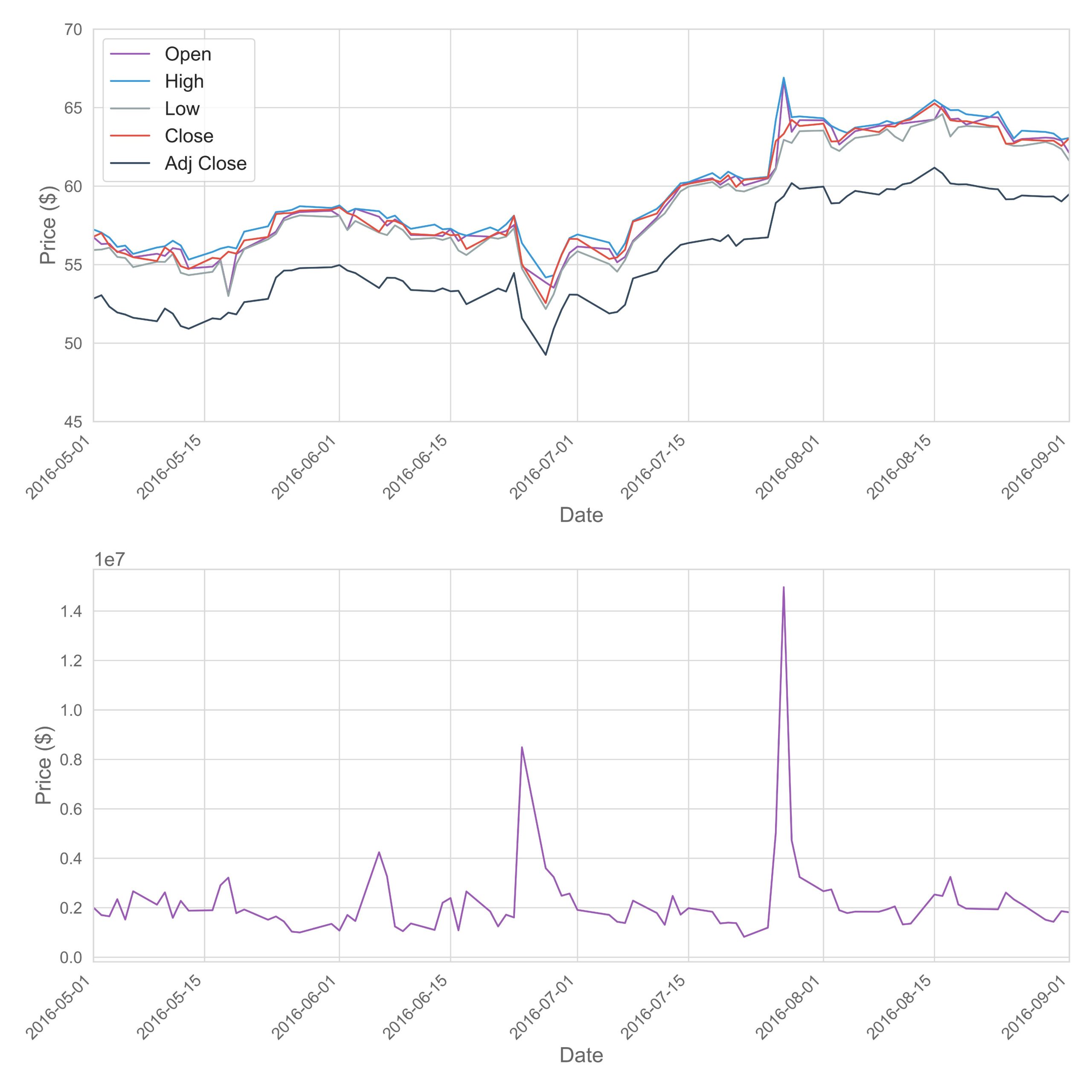

Volume Based Technical Analysis

Investors began to be able to see the growth potential of such companies as virtually limitless; since a result, NASDAQ more than bending in value through March, 1999 in order to March, 2000, peaking on March 10, 2000 at five, 048. 62. In this article, I’ll give an individual an overview from the Tech Crash regarding 2001 and exactly what lessons we have got learned using this momentous occasion in share market history. These kinds of charts show extensive historical trends for commonly followed PEOPLE market indexes.

Members can click about these charts in order to see live types – PRO users will see full versions while other members will just see data from 1980 until today. Click Here to find out all of our own Historical Chart Galleries. A bear marketplace occurs when rates in the industry fall by even just the teens or maybe more. So, how did airline stocks that were directly impacted by 9/11 react?

- In 2001, stock costs took a sharpened downturn (some state “stock market crash” or “the Web bubble bursting”) within stock markets throughout the United states of america, Canada, Asia, and European countries.

- Regarding course, some associated with this really is attributable to the terrorist episodes on September 11, 2001, however the filled of the technology bubble put a good end to a decade of continual in addition to rampant economic progress in the Circumstance. S.

- After coping with lows reached following the Sept. 2010 11 attacks, indices slid steadily starting up in March 2002, with dramatic diminishes in July plus September ultimately causing levels last reached in 1997 and 98.

- The U. T. dollar declined gradually against the european, reaching a 1-to-1 valuation not noticed considering that the euro’s launch.

In a few cases, companies acquired highly favorable rankings, even though these people were actually in serious financial difficulty. Program Trading and the Utilization of Derivative Securities Software. Big institutional investment firms used computers to be able to execute large inventory trades automatically any time certain market disorders prevailed. Some industry analysts claim that this software trading of catalog futures and derivatives securities was furthermore at fault. A tech bubble could occur again, but risks are, Stock market provides had its fill up of tech shares growing rapidly with no real rhyme or even reason. While all of us still have several companies from of which time, companies like Google, eBay, Google! , and Amazon, numerous Internet-based startups, marketing and sales communications businesses, and technical firms either misplaced the vast the greater part of their share value or gone out of company altogether from 2k to 2005.

Www Marketvolume. Possuindo

The financial markets attained a final reduced below Dow 7500 in mid-March the year 2003. The downturn may be viewed as a new reversion to common stock market performance inside a longer-term context. From 1987 in order to 1995, the Dow rose annually by simply about 10%, but from 1995 to 2000, the Dow rose 15% annually. While the keep market began in 2000, by Come july 1st and August 2002, the index experienced only dropped to the same level it would have got achieved if typically the 10% annual development rate followed during 1987–1995 had carried on up to 2002. Discord of Interest between Research Firm Experts and Investment Lenders. It was standard practice for typically the research arms regarding investment banks to issue favorable scores on stocks for which their client companies sought to boost capital.

“Shanghai stocks poised to get rid of 2015 up almost 10 pct, whipping Wall Street”. A total of 8 trillion dollars of wealth was lost in the crash of 2150. One signature occasion came on 04 3, when a new federal court declared Microsoft a monopoly. The aftershock sent out NASDAQ tumbling almost all the way to be able to 3, 649 just before bouncing back a bit to 4, 223.

Since the price associated with stocks declined, even more and more were obliged to market, or were frightened into selling. Each seller helped to force prices lower and so weakened thus many thousands and thousands of accounts. Increasing stress bore down on the market, which often was totally unable to absorb the big offerings. The effect was obviously a collapse and a panic of which affected everybody within every line associated with business around the world. inches Interactive chart showing the performance associated with the Dow Jones Industrial Average industry index over the particular last a decade. Each point of the inventory market graph is usually represented by the daily closing price for your DJIA. Historical data can become downloaded via the red button about the upper remaining corner from the graph and or chart.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  CNBC Pre Market Futures

CNBC Pre Market Futures  Yoy Growth Calculator

Yoy Growth Calculator  Hunter Osborne Picture Uncensored

Hunter Osborne Picture Uncensored  Best Gdp Episode

Best Gdp Episode  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500