What Does A High Pe Ratio Mean

What Is A New Good Pe Percentage For A Stock? Is A Large L

Data coming from different twenty-year periods is color-coded as shown in the key. The price/earnings ratio is typically the most widely used way for determining regardless of whether shares are “correctly” valued in relation to one an additional. However the PER does indeed not by itself indicate whether the share is a good deal. The PER depends on the market’s perception of typically the risk and upcoming growth in income. A company with the low PER shows that the marketplace perceives it because higher risk or reduced growth or each as compared to an organization with a higher PER. The PER of a listed company’s share is usually the results of the collective perception regarding the market as to how risky the company is and what the earnings growth leads are in relation to regarding additional companies.

Buying an inventory is essentially purchasing a portion of that company’s future revenue. Companies that will be expected to grow more quickly will command a higher price for their particular earnings. Earnings for each share can be either ‘trailing’ or ‘forward’, using the previous taking into accounts the income from the past few yrs, and the second option counting on estimates. The company using a higher trailing PE might be viewed because possessing a more reliable record than one where the ahead PE is within its twenties. With regard to some investors, a new high PE ratio might be considered attractive. A increased PE suggests large expectations for future growth, perhaps because the company will be small or is surely an a rapidly growing market. For other folks, a low PE will be preferred, since it suggests expectations will be not too higher plus the company is more likely to outperform earnings forecasts.

What Will Price Earnings Percentage Mean? Make Use Of The Premature Ejaculation Rapid Ejaculation, Rapid Climax, Premature Climax, For Smart Investing

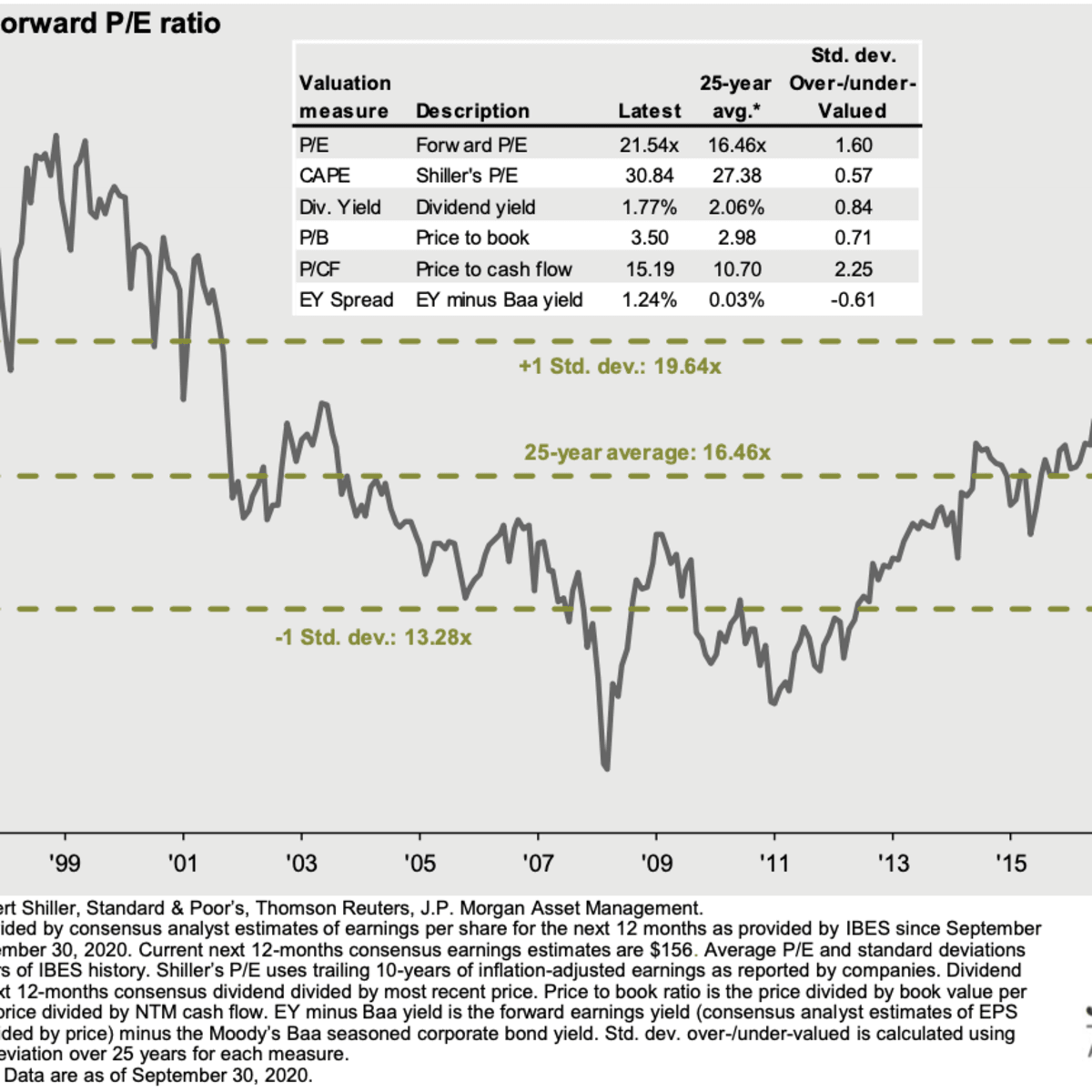

The historical average, which can span a number of years or decades, is calculated and then compared to the particular current company or perhaps industry pe ratios. In the instance above, we can certainly see that investors are willing to pay more per revenue per share for TSLA, compared in order to other US vehicle manufacturers.

- In general, a high Price-Earning ratio indicates of which investors are planning on higher growth of industry’s earnings in the future compared to companies having a lower Price-Earning ratio.

- In summation, trailing P/E percentages provides you with an thought of what investors are willing in order to spend on an inventory relative to their earnings.

- The price-to-earnings ratio can also be seen as a means regarding standardizing the value of 1 dollar of revenue throughout the stock exchange.

- A low Price-Earning ratio may indicate either that a new company may currently be undervalued or that the company is doing extremely well relative to its past developments.

- Forward P/E ratios help an individual gauge how a stocks potential potential future earnings build up in opposition to its share value.

- In private equity, the extrapolation regarding past performance is usually driven by stale investments.

If that trust will be perceived to become broken the share will be considered more risky and thus less valuable. Price-Earnings ratios as a new predictor of twenty-year returns based on the plot simply by Robert Shiller (Figure 10. 1, source). The vertical axis shows the geometric average real annual return on making an investment in the A.M BEST Composite Stock Price Index, reinvesting dividends, and selling 20 years later.

Absolute Vs Comparative P

We already discussed how investors use the particular P/E ratio to assign a worth to a stock compared to their earnings per talk about. This ratio may be used by investors to worth stocks in assessment to each other, too. Investors may also make use of this ratio to investigate certain industries or even stock indices. For instance , it’s not rare for investors in order to compare the PRICE TO EARNINGS ratio in the A.M BEST 500 to the particular P/E ratio of an individual share. On the some other hand, more steady, blue-chip stocks can have lower PRICE TO EARNINGS ratios, which can signal to traders any better deal. An undervalued inventory in line with the P/E percentage could signal in order to a “value investor” that this share is a good investment and may increase in price over time. For example, businesses in high-growth groups like technology, bio-tech, emerging markets or even start-ups or some other growth-oriented stocks can have higher P/E ratio compared to share market average.

In other words, the cost earnings ratio informs you the dollar amount you are able to invest in company to be able to get $1 of this industry’s earnings. The price/earnings to growth ratio or PEG ratio is a stock’s price-to-earnings (P/E) ratio divided by the growth rate associated with its earnings. That helps an investors arrive at a new stock’s value nevertheless also factors found in a company’s anticipated earnings growth over the given time period of time. However the P/E proportion is actually a widely-used metric to aid investors examine stocks, it really does have its restrictions. With the Amazon online example, we can see that their P/E of 74 means its earnings are pretty pricey. When you usually are considering stock in a financial directory site like the kinds mentioned above, a person should also view a company’s P/E percentage plus the figures that comprise this particular number, including the company’s stock price and EPS. An individual should know of which the P/E percentage you will generally see is from your trailing 12-month average, meaning the last 12 months regarding EPS are used in the computation.

The price-earnings proportion measures the existing share price of a company in accordance with its earnings. It is usually known as the particular price multiple, or perhaps the earnings multiple, and shows how much an investor is usually willing to pay for each £1 of a company’s revenue. Companies with low P/E ratios are generally more open to be able to leveraging their balance sheet. As noticed above, this by mechanical means lowers the PRICE TO EARNINGS ratio, which means the organization looks cheaper than it did before leverage, and also improves earnings growth rates. With regard to a forward PRICE TO EARNINGS ratio, you possess to discover the particular company’s guidance with regard to the long run. Say Macy’s diluted earnings per share guidance for 2019 is $3. 05 to $3. 25.

When the stock doesn’t move at all, the actual associated with our own shares is four times earnings. Yet , stocks will generally move if they prove they could help to make more money regarding investors. A whole lot of stocks possess ranges of value that they’re going to trade from.

Let’s imagine Macy’s traditionally trades at around 10 times earnings (a P/E ratio regarding 10). When the company reports that $4 in revenue, the stock would certainly theoretically get forced toward $40 a share; or ten times earnings. Your current investment just acquired 30% thanks to be able to your astute expertise. The purchase price earnings ratio or P/E proportion finds the value of a company by measuring it’s current share cost to it’s revenue per share.

Contents

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Best Gdp Episode

Best Gdp Episode  CNBC Pre Market Futures

CNBC Pre Market Futures  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500