Xendit: A digital payment gateway provider for Indonesia.

The company uses the Indonesian rupee as its settlement currency, but merchants can accept other currencies as well. Thanks to Dynamic Conversion, currencies are converted instantly at the current bank rate. Since we have decided on the most obvious criteria for choosing the best payment gateway, consider the Indonesia payment gateway comparison. Merchants are primarily concerned with making payments fast, smooth, and secure. It improves customer confidence in the site and increases conversion rates. In-depth industry statistics and market share insights of the Indonesia Payments Infrastructure sector for 2020, 2021, and 2022. The Indonesia Payments Infrastructure research report provides a comprehensive outlook of the market size and an industry growth forecast for 2023 to 2028.

Before COVID-19, many of Xendit’s customers were in the travel industry, and it was hit hard by the pandemic. To activate your account, submit your company documents to Xendit based on your business type. Your customers can easily pay with cash over the counter nationwide via 7-Eleven stores.

With the Indonesia Payment Systems Blueprint 2025, the country aims to make digital innovation accessible for 91.3 million unbanked people and 62.9 million MSMEs in Indonesia to formal economics and finance in a sustainable manner. Thus, all efforts are directed toward a stronger and more evenly distributed Indonesia in the future. Some of Xendit’s competitors in its current markets include Midtrans in Indonesia, which wasacquired by Gojek in 2017, and PayMongo in the Philippines, which isbacked by Stripe. Looking ahead, Xendit plans to use the funding from its Series C round to support further regional expansion, likely in Malaysia and Vietnam. Gateway for merchants grows rapidly in Indonesia, eyes further expansion in Southeast Asia.

In the last year, Xendit’s annualised transactions tripled from 65 million to 200 million while its total payments value jumped from $6.5bn to $15bn. Our integration with QRIS now allows your customers to pay seamlessly from top eWallets and top mobile banking applications . With an inai integration, you can set up shop in less than 60 mins with no code. You’ll even be able to customise your checkout to your branding and direct each customer to a designated payment gateway based on the best transaction pricing and success rate. Now, imagine a scenario where a payment gateway that is supplying your main payment methods goes down. That downtime will also be affecting your business, which you can have no control over until the payment gateway fixes the problem or integrates with another payment gateway.

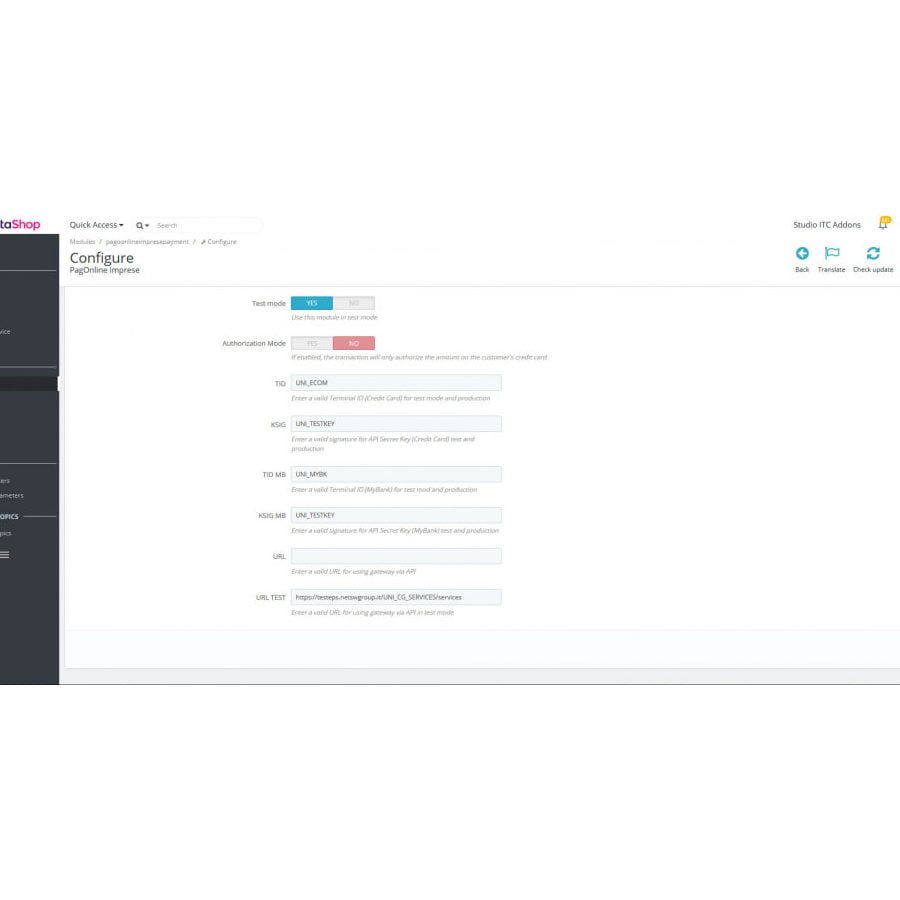

Adobe Commerce Platform Compatibility

Last but not least, you should check to make sure whether a native integration is available for your platforms and the ease of integration. When expanding into new markets, you want to set up shop as quickly as possible. Native integrations ensure a reduction of payment errors on the customer’s end and higher conversion rates on yours.

- The collaboration will see Xendit bring its global expertise to synergise with Payex’s local knowledge driving merchant acquisition and local expansion.

- Few Indonesian payment gateway service vendors also provide hotline customer support services that are active 24 hours a day and 7 days a week.

- Xendit boasts over 3,500 active customers across the region and has recorded over $21 billion in annualized third-party verifications across over 250 million transactions in total.

- Wijaya’s efforts to get more women into tech careers can be seen at Xendit.

In connection with such diversification, it is essential to connect a payment gateway that can satisfy the needs of those customers who, for one reason or another, prefer non-standard solutions. Integrating a payment gateway, or the so-called Internet acquiring, to the website expands the possibilities for paying for goods and services. Such trends are expected to spur strategic collaborations and innovations by the solution providers in the country. With the recent acquisition of MOKA by Gojek, connectivity between online delivery service and POS terminal appears to be on the horizon. Prior to that, Pawoon has made the first move for integration by connecting transactions from GrabFood into its system. Electronic data capture machines/POS terminals are used for accepting payments at all retail outlets.

Xendit Is Celebrating, And You’re Invited! 🎉🎉

With a focus on SME’s, over 10,000 small businesses choose Xendit as their payments provider. Xendit is one of the leading payment gateways in Indonesia, the Philippines and all of Southeast Asia. The company provides services to various types of businesses and offers easy payment gateway integration. The user base for digital payment methods in the country is on the rise, and consumers are increasingly using the technology on a regular basis.

As such, as of July 2020, QRIS has facilitated around 11 million transactions with a total value of about IDR 790 billion. Integration of the payment gateway to the site takes place in several possible ways. Today we would like to dwell on the process of user verification itself.

- In addition, the company has one of the largest number of payment methods among payment providers .

- Xendit payment gateway has its own fraud detection system for better risk management.

- Since it was established in 2015, the company has expanded its services to include fraud detection, lending, and tax management.

- The round was led by Tiger Global Management, with participation from returning investors Accel, Amasia and Goat Capital, the venture firm co-founded by former Y Combinator partner Justin Kan .

Give your customers the flexibility of buy now, pay later installment plans through Xendit’s integration with Kredivo. Xendit is not a peer to peer lending company and does not have personal lending products. If you come across a fraudulent attempt using the Xendit brand, please inform us via live chat. Beware of Fraud Attempts Xendit is not a peer to peer lending company and does not have personal lending products. Get started with Xendit easily with your choice of Live URLs, Web/mobile checkout or API integration. Try it out with our sandbox environment, where you can start testing with a simple login. Putu Sayoga for Forbes AsiaWith more mobile connections than people in Indonesia, but with 66% of the population unbanked, Wijaya sees a huge opportunity.

For merchants, it’s becoming even more difficult to integrate with each payment gateway that they need, sometimes costing businesses hundreds of hours of manpower and resources in the engineering team to integrate and maintain. Furthermore, OVO ranked first among the most-used digital payment platforms in Indonesia as of 2020, followed by Gopay and DANA. The security of the platform and its enriching customer services were the top reasons why consumers preferred these payment platforms. Additionally, mobile POS terminals have quickly evolved as an essential tool enabling merchants of all sizes to accept card payments. They are being used increasingly for payments, inventory management, printing bills, and offering loyalty programs across various industry verticals. With more than 3,000 customers, Xendit’s competitive differentiator is its deep understanding of local customer needs combined with global technology. Many Indonesian payment gateway vendors have easily understandable and fast administrative and technical processes that makes onboarding a smooth experience for the merchant.

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  CNBC Pre Market Futures

CNBC Pre Market Futures  Robinhood Customer Service Number

Robinhood Customer Service Number  90day Ticker

90day Ticker  pawfy

pawfy  Arvin Batra Accident

Arvin Batra Accident