Crypto card: Debit card that allows users to pay with cryptocurrency. It works by converting the digital currency instantly at the point of transaction.

Unfortunately, the amount it is advisable to put up makes the highest card irrelevant to all or any but the most devoted of crypto enthusiasts.

In effect, the two highest levels are out of reach for most, making the advertised rate of “up to 5%” somewhat misleading.

- What they may not need predicted was the move towards legitimizing crypto using traditional financial loans.

- All you need would be to hold bitUSD on your own OpenLedger

- For instance, it is possible to tell Shift to spend your bitcoins first, also to use your Dwolla account as a backup once your Coinbase hot wallet is empty.

- First, they offer a secure way to store and transact with cryptocurrencies without the need for an exchange or other third-party provider.

- In the past, you had to go to an exchange, and sell your cryptocurrency for a USD.

Coinbase is among the more prominent names in crypto, with it being one of the largest exchanges and the first ever to claim an area on the New York stock market.

The Coinbase Visa advantages from the company’s experience creating and owning a high-level financial exchange in a relatively new and competitive industry.

This site is section of a joint venture partner sales network and receives compensation for sending traffic to partner sites, such as for example CreditCards.com This compensation may impact how and where links appear.

This site does not include all financial companies or all available financial offers.

Where Can I Work With A Crypto Debit Card?

Wirex Card is among the longest-running crypto cards around.

The company ‘s been around since 2014 and offers its card in america.

There exists a token called X-points that’s attached to the Wirex card, which must be converted into cryptocurrencies.

The card offers a great cashback rate as high as 8% but doesn’t offer many additional rewards or benefits.

Did you know the world’s biggest crypto exchange offered a card?

The Binance Card premiered back 2020 and supports payments in a wide variety of cryptocurrencies such as for example Bitcoin , Binance Coin , Ethereum , and, Binance USD .

Just like with the Coinbase card we mentioned earlier, the Binance Card holds cryptocurrency in your wallet and only converts the total amount that’s needed during purchase.

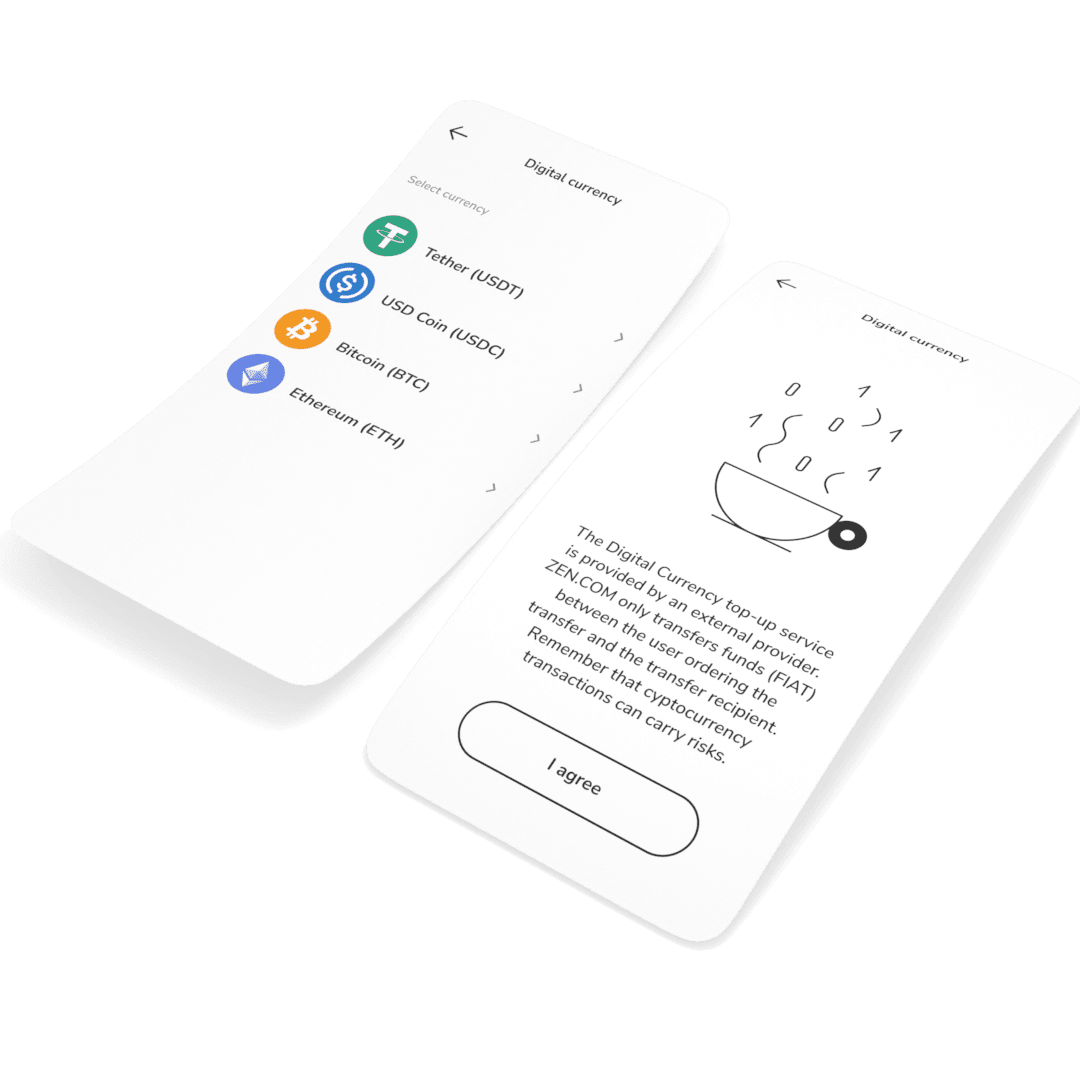

Get swept up on the fundamentals of crypto and learn about Visa’s vision for supporting digital currency.

Get swept up on the fundamentals of digital currency—including the various forms of digital currency, the digital currency landscape, and many more.

Also, learn all about Visa’s vision for supporting digital currency as its usage continues to accelerate.

Discover an innovative method of face-to-face digital currency transactions.

Our first consideration was that it must be convenient to use and create a seamless transition from cryptocurrency conversion to get or withdrawal.

Get started with easy and simple & most secure platform to get, sell, trade, and earn cryptocurrencies.

Cryptocom Private

Some crypto cards are providing a waitlist, but if you’re eager to apply and begin earning—the following cards are open for application.

Blockcard is primarily popular because of the generous cashback rewards.

These rewards can range from 1-6% depending on the tier of card chosen.

Blockcard offers additional rewards for users who use their card a lot on a month-to-month basis.

Instant card freezing, two-step verification for top-notch security, PIN protection, or contactless withdrawals are methods to safeguard cryptocurrency.

You utilize the cryptocurrency at this point you have in the wallet to secure or insure the loan.

Thus, you might only accept a loan whose value is lower than the value of the cryptocurrency holdings.

Users of the Nexo MasterCard physical cryptocurrency credit card can borrow around US$2 million against their cryptocurrency holdings.

Among those services may be the Nexo Card, that allows you to spend without selling your crypto.

The card works by making use of your crypto as collateral and can be used at millions of merchants worldwide.

You may use your virtual and physical cards to cover any physical goods, such as for example groceries, in any location that accepts Mastercard.

People from the EU/EEA/GB regions may also be able to open a traditional bank account.

Nowadays, cryptocurrency is used by an increasing amount of people from across the world.

Since digital assets are section of our daily lives, more folks want in how they are able to utilize it as payment.

Cardholders who don’t want to spend $400 on a Visa card can also opt for Crypto.com’s Midnight Blue card, that provides no ATM fees for up to $200 of withdrawals each month.

It offers a stylish option to traditional banking by combining a rewards rate as high as 8% cashback on your own purchases.

Our first consideration was to find cards that were simple to use and created a seamless transition from cryptocurrency conversion to get or withdrawal.

Nonetheless, some consider Bitcoin debit cards less secure than offline digital wallets.

Crypto Cards Have Any Risks?

Others require users to purchase a card or invest in the card’s native currency.

You can transfer Bitcoin from the debit card to fiat currency via an exchange or Bitcoin ATM.

Whether or not a Bitcoin debit card is practical for you depends on whether you use cryptocurrency.

If you’re quite happy with a regular debit card and don’t regularly use cryptocurrency to make purchases, then a Bitcoin debit card will not be necessary.

However, in the event that you regularly favor cryptocurrency over fiat currency when shopping, a Bitcoin debit card could make your life easier.

There exists a potential 2.49% conversion fee for non-USDC cryptos upon transactions or ATM withdrawals.

ZDNET’s recommendations are based on many hours of testing, research, and comparison shopping.

We gather data from the best available sources, including vendor and retailer listings along with other relevant and independent reviews sites.

And we pore over customer reviews to learn what counts to real individuals who already own and utilize the services and products we’re assessing.

Nexo Card, which deducts purchases from your own available credit line, using digital assets as collateral.

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  CNBC Pre Market Futures

CNBC Pre Market Futures  Best Gdp Episode

Best Gdp Episode  PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.

PlushCare: Virtual healthcare platform. Physical and mental health appointments are conducted over smartphone.  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  Robinhood Customer Service Number

Robinhood Customer Service Number  90day Ticker

90day Ticker  Mutual Funds With Low Initial Investment

Mutual Funds With Low Initial Investment