Monte Carlo Simulation

Simulation

Probability distributions usually are a much even more realistic way of describing uncertainty in variables of any chance analysis. Submit the work plan for EPA review prior to doing it Monte Carlo simulation, to guarantee the work will probably be acceptable to ENVIRONMENTAL PROTECTION AGENCY. The workplan ought to describe the software used, the direct exposure routes and designs, and input likelihood distributions and their own sources. EPA desires that peer-reviewed literature and site-specific data will be applied whenever possible. Use expert judgment only because a final measure, and only in the form of triangular or perhaps uniform distributions. Typically the main idea behind this method is that the the desired info is computed based about repeated random testing and statistical research.

- Investors, he or she said, might have trouble in reconciling the difference between a 50% versus 70% probability of success.

- A Monte Carlo simulation allows experts and advisors to be able to convert investment possibilities into choices.

- A simple example of how a pc would perform a new Monte Carlo ruse is the calculations of π.

- A Mucchio Carlo simulation can be used to be able to tackle a selection of problems in virtually every discipline such as financial, engineering, supply cycle, and science.

- The workplan ought to describe the software used, the direct exposure routes and versions, and input likelihood distributions and their particular sources.

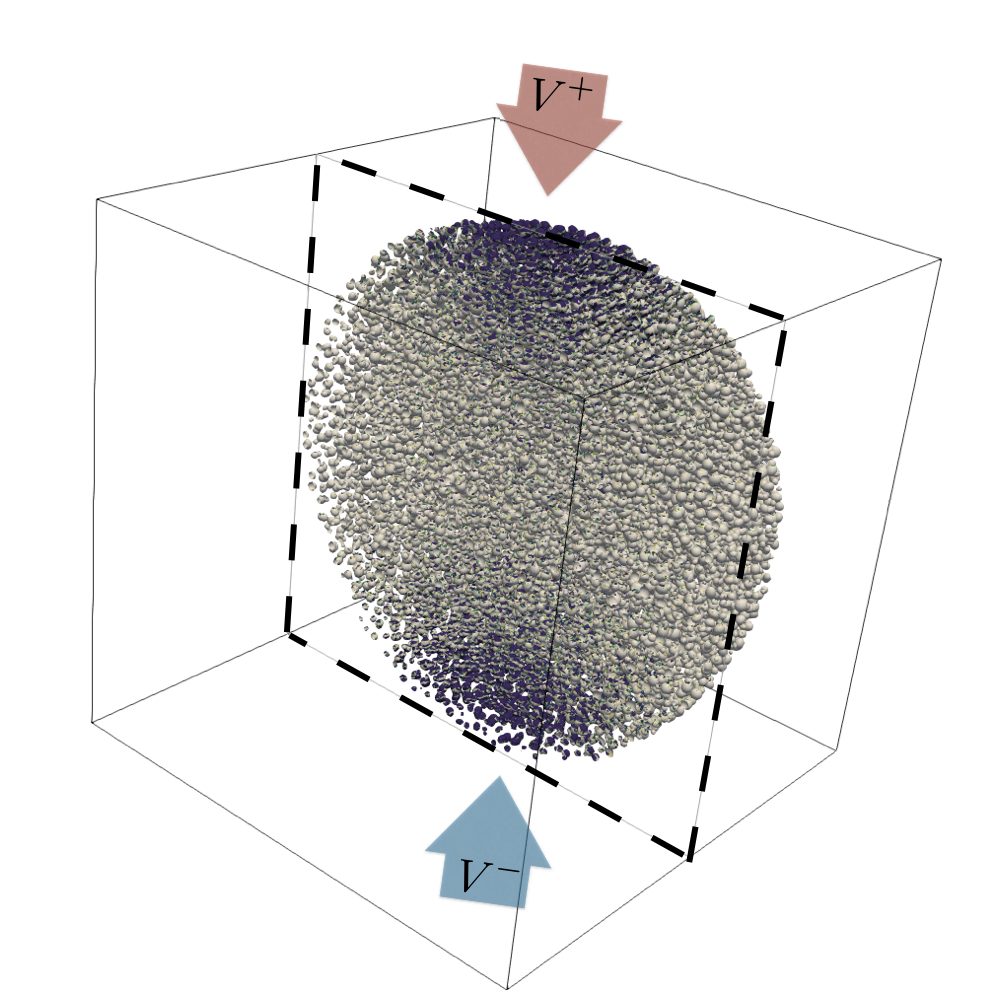

In statistical physics Monte Carlo molecular modeling is definitely an alternative to computational molecular dynamics, and Mucchio Carlo methods are used to compute statistical industry theories of simple particle and polymer bonded systems. Quantum Monte Carlo methods fix the many-body trouble for quantum systems.

We All And Our Lovers Process Data To:

Essentially, the Monte Carlo technique solves a trouble by directly simulating the actual process in addition to then calculating the particular result of the process. This very general approach is usually valid in areas such as physics, chemistry, computer technology etc. This post discusses typical monetary problems in which usually Monte Carlo procedures are used. In addition, it touches on typically the usage of so-called “quasi-random” methods such since the use of Sobol sequences. The advent of spreadsheet programs for personal computers provided an opportunity for specialists to make use of Monte Carlo simulation in each day analysis work. Ms Excel is the dominant spreadsheet research tool and Palisade’s @RISK is recognized as a prime Mucchio Carlo simulation add-in for Excel.

Value sampling includes simulating the Monte Carlo paths by using a various probability distribution that will will give even more likelihood for the particular simulated underlier in order to be situated in the particular area where typically the derivative’s payoff has the most convexity. The simulated payoffs are then not necessarily simply averaged as in the case of a simple Mazo Carlo, but are first multiplied from the likelihood ratio between the revised probability distribution and the original 1. This will guarantee that paths whoever probability happen to be randomly enhanced from the alter of probability distribution are weighted together with a low bodyweight. Square root affluence is slow, and so using the trusting approach described above requires using a new very large number of sample paths in order to obtain an accurate result.

Guidelines For Using Monte Carlo Simulation

Learn everything a person need to know about the Monte Carlo Ruse, a type of computational algorithm that will uses repeated random sampling to obtain the likelihood regarding a range of results regarding occurring. Multiple geradlinig regression is actually a statistical technique that employs several explanatory variables to predict typically the outcome of a response variable.

This design helps to ensure that the portfolio never runs out, but the annual spending amount varies centered on the collection growth. The percent based withdrawal may be smoothed by using the going portfolio average or a geometric spending rule. Include chart and tables showing and describing each and every input distribution, distributions of risk for each and every exposure route, plus distributions of overall risk.

A patient’s risk and return profile is typically the most important factor influencing portfolio management decisions. The customer’s required returns are a function associated with her retirement in addition to spending goals; the girl risk profile will be determined by the woman ability and willingness for taking risks. Even more often than not really, the desired return in addition to the risk user profile of a client are not in sync with each other. For illustration, the degree of risk appropriate to a client may possibly make it unattainable or very difficult to attain the wanted return. Moreover, a minimum amount may possibly be needed before retirement to attain the client’s goals, but the customer’s lifestyle would not really permit the savings or the client might be reluctant to change it. Monte Carlo simulations can end up being best understood by simply considering a person throwing dice. A new novice gambler that plays craps initially will have simply no clue what typically the odds are to be able to roll a half a dozen in any blend.

To compare competing statistics for little samples under reasonable data conditions. ] This is usually because the “what if” analysis gives equal weight in order to all scenarios, as the Monte Carlo technique hardly samples within the very low probability regions. There are usually ways of working with probabilities that are usually not really Monte Carlo simulations – for example, deterministic recreating using single-point estimates. Each uncertain varying within a type is assigned a “best guess” estimate. Pseudo-random number sampling algorithms are used to transform consistently distributed pseudo-random amounts into numbers that are distributed in accordance with a given probability distribution. Quantum Monte Carlo, and considerably more specifically diffusion Monte Carlo methods can also be interpreted being a mean industry particle Monte Carlo approximation of Feynman–Kac path integrals. We all also quote a good earlier pioneering content by Theodore At the. Harris and Herman Kahn, published in 1951, using mean field genetic-type Mazo Carlo techniques for price particle transmission efforts.

Trending Topic:

Market Research Facilities Near Me

Market Research Facilities Near Me  Cfd Flex Vs Cfd Solver

Cfd Flex Vs Cfd Solver  Best Gdp Episode

Best Gdp Episode  Tucker Carlson Gypsy Apocalypse

Tucker Carlson Gypsy Apocalypse  Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.

Stock market index: Tracker of change in the overall value of a stock market. They can be invested in via index funds.  CNBC Pre Market Futures

CNBC Pre Market Futures  90day Ticker

90day Ticker  Robinhood Customer Service Number

Robinhood Customer Service Number  List Of Mutual Funds That Outperform The S&P 500

List Of Mutual Funds That Outperform The S&P 500  Phil Town Portfolio

Phil Town Portfolio